Investment Thesis and Strategic Focus

Core Investment Principles

Canaan Partners' investment thesis is rooted in early-stage investments within the technology and healthcare sectors. The firm targets massive market opportunities and emphasizes partnerships with visionary founders. Their approach is characterized by a focus on Seed and Series A investments, aiming to build sector-defining companies. Canaan values diversity of thought and maintains a team with varied expertise, including scientists, engineers, and former CEOs, to enhance investment decisions. They prioritize respect, transparency, and collaborative problem-solving in their relationships with portfolio companies.

Sectors and Technologies of Focus

Canaan Partners prioritizes sectors with high disruption potential and scalable growth, specifically in technology (enterprise software, fintech, cybersecurity, and frontier tech like robotics) and healthcare (biotech, digital health, and precision medicine). Recent expansions include consumer and frontier technology, with 40 Seed/Series A investments in consumer ventures over the past two years. The firm is also focusing on emerging trends in AI-driven logistics and advanced security platforms, as seen in investments like Snyk and Dragos.

Alignment with Mission and Vision

Canaan Partners' mission and vision align with their strategic focus on building companies led by transformative entrepreneurs. Their commitment to supporting underrepresented founders and communities reflects their ethos of diversity and inclusion. Canaan's track record, which includes 66 IPOs and 141 M&As, underscores their ability to identify and nurture companies with significant growth potential. Examples of successful exits, such as The RealReal and Instacart, illustrate the firm's effectiveness in executing its investment thesis.

Conclusion

Canaan Partners' investment strategy is distinguished by its combination of sector breadth, early-stage conviction, and diverse expertise. Their focus on technology and life sciences, along with their commitment to transformative leadership, positions them to effectively capitalize on emerging market trends and opportunities.

Portfolio Composition and Sector Expertise

Canaan Partners has established itself as a formidable player in venture capital, with a portfolio composition that showcases their expertise in both technology and healthcare sectors. With over 1,100 investments and more than 230 successful exits, Canaan Partners strategically allocates approximately 60% of its capital to technology ventures and 40% to healthcare. ### Key Sectors and Industries Canaan Partners' focus in the technology sector includes **AI, enterprise software, fintech, consumer internet, e-commerce, and cybersecurity**. Notable companies in this category are **Instacart**, **The RealReal**, and **LendingClub**. In the healthcare sector, Canaan Partners invests in **biotechnology, digital health, medical devices, and diagnostics**, with companies like **Arvinas** and **Genome Medical** leading the way. Canaan Partners has demonstrated a robust balance between early-stage and late-stage investments. Their early-stage focus allows them to nurture potential market leaders, while strategic late-stage investments enable them to capitalize on more mature opportunities. This balance is evident in their portfolio evolution, which includes both new ventures like **UrbanSitter** and mature exits such as **Capella Space**. In terms of sector strengths, Canaan excels in technology and healthcare innovations, while their relative weakness may lie in sectors with lower investment frequency, such as traditional manufacturing or non-digital consumer goods. Overall, Canaan Partners' strength lies in their ability to identify and invest in innovative companies within technology and healthcare, while they may need to expand into less explored sectors to further diversify their portfolio.Investment Criteria

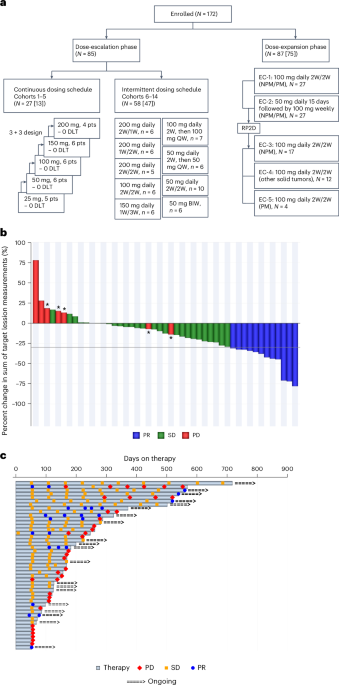

Canaan Partners is a prominent venture capital firm with a keen focus on early-stage technology and healthcare investments. They strategically support visionary founders with transformative ideas, aligning with their investment philosophy that emphasizes collaboration and hands-on involvement. ### Key Investment Criteria 1. **Preferred Investment Stage:** Canaan Partners primarily invests in early-stage companies, focusing on Seed to Series B rounds. However, they are open to select later-stage opportunities, particularly in the healthcare sector, such as Series C investments. This focus allows them to nurture startups from their inception through critical growth phases. 2. **Typical Check Size:** Their investments range from **$500,000 to $20 million**, with an average company allocation of **$15–20 million**. For seed and Series A rounds, typical check sizes are between **$1 million and $10 million**. This financial flexibility ensures they can support diverse business needs, from initial growth to expansion stages. 3. **Geographic Focus:** While Canaan Partners primarily targets the United States, their investment reach extends to North America, Europe, and Israel—particularly for technology ventures. This geographic diversity reflects their commitment to sourcing innovative opportunities across major global markets. Canaan Partners looks for companies with disruptive business models, strong management teams, and scalable technology. Their approach includes active involvement, providing strategic guidance, business development insights, and talent recruitment support. This long-term partnership often extends over a 5-7 year holding period, allowing them to deeply influence the trajectory of their portfolio companies. ### Notable Investments Canaan Partners' investment in biotech and pharmaceuticals, such as the YAP/TEAD inhibitor VT3989 trial in solid tumors, showcases their commitment to transformative healthcare solutions. Their investment strategy aligns with supporting companies that have the potential to make significant impacts in their respective fields, whether through technological innovation or medical advancement. This strategic alignment with high-growth potential startups ensures that Canaan Partners remains at the forefront of venture capital investment.Track Record and Notable Exits

Canaan Partners, a prominent venture capital firm, has established a significant track record with numerous successful exits, including both IPOs and acquisitions. These exits span technology and healthcare sectors, reflecting Canaan's strategic investment approach. Below is an overview of some of Canaan Partners' most notable exits: ### Notable Exits 1. **Instacart (IPO, 2023):** Canaan was an early investor, contributing to its growth until its public listing. 2. **Ring (Acquired by Amazon, 2018):** Canaan led the Series A round, culminating in a $1 billion acquisition. 3. **Dexcom (IPO):** A pivotal exit in the healthcare device sector. 4. **Match.com (Acquired/IAC, IPO):** Early investment; now a leading online dating platform. 5. **LendingClub (IPO):** One of the largest fintech IPOs in the U.S. 6. **Care.com (IPO 2014, acquired by IAC in 2020):** Guided through IPO, showcasing adaptability. 7. **Check Point Software (IPO 1996):** Early investment in cybersecurity. 8. **SuccessFactors (Acquired by SAP, 2011):** Enterprise SaaS exit valued at $3.4 billion. Financially, these exits have significantly impacted Canaan Partners' reputation, reinforcing their status as a leading early-stage investor. Notably, the acquisition of Ring by Amazon and the IPO of Instacart highlight Canaan's ability to identify and nurture companies with high growth potential. This success is attributed to Canaan's strategic focus on early-stage companies with innovative solutions, particularly in sectors poised for exponential growth. This approach is evident in their support for AI-driven platforms, such as the recent launch of Sumble, which secured a $38.5M funding round to enhance its AI-powered go-to-market intelligence platform. Canaan Partners' track record is a testament to their investment acumen, with 73 IPOs and 152 M&As to date, underscoring their influential role in driving technological and healthcare advancements.Team Composition and Decision-Making

Canaan Partners is a prominent U.S. venture capital firm known for its diverse and expert investment team. The firm emphasizes diversity, with 40% of its investment team being women, significantly above the industry average. Key team members include:

Key Team Members and Expertise

- Eric Young — Co-Founder and Partner.

- Brent Ahrens — General Partner.

- Stephen Bloch — General Partner.

- Maha Ibrahim — General Partner, specializing in e-commerce and cloud technologies; an early investor in The RealReal.

- Wende Hutton — General Partner.

- Colleen Cuffaro — General Partner.

- Brendan Dickinson — General Partner, leading the Fintech practice.

- John Pacifico — General Partner, COO + CFO.

- Janet Bell — Analyst with a background in operations and HR.

Decision-Making Process

Canaan Partners employs a data-driven, collaborative decision-making process that is pivotal to its investment strategy. This process is characterized by:

- Data-Informed Evaluation: Utilizing historical investment data to create detailed frameworks, focusing on metrics such as unit economics and market expansion.

- Sector Specialist Teams: Dedicated teams for healthcare, enterprise technology, fintech, and other sectors apply deep domain knowledge to evaluate opportunities.

- Rapid, Structured Diligence: The use of data frameworks enables quicker, conviction-driven decisions and focused partner discussions.

- Partner Collaboration: Investment decisions are made collaboratively, leveraging the collective expertise of partners across various domains.

Impact on Success

The expertise and structured decision-making process at Canaan Partners have been instrumental in its success. For instance, Maha Ibrahim's early investment in The RealReal highlights the firm's ability to identify and support promising ventures in the e-commerce sector. The collaborative and data-driven approach not only enhances decision-making speed but also ensures precision in selecting high-potential investments, contributing to Canaan's robust portfolio management.

Value-Add Capabilities and Support

Canaan Partners stands out in the venture capital landscape for its comprehensive value-add capabilities that extend beyond mere financial investment. Their approach is rooted in strategic mentorship, expansive networking, and operational support, which collectively drive the growth and success of their portfolio companies.

Resources and Mentorship

Canaan Partners offers personalized, one-on-one mentorship to entrepreneurs, focusing on refining business models and navigating industry challenges. The firm’s seasoned investment professionals collaborate closely with founders, providing strategic insights derived from decades of experience in venture capital and operational leadership.

Support Programs and Initiatives

Beyond mentorship, Canaan facilitates extensive networking opportunities, connecting startups with industry leaders, potential acquirers, and strategic partners. Their operational support includes product development advice, market entry strategies, and recruitment assistance for executive teams, which are crucial for early-stage companies aiming to scale efficiently.

Impact on Portfolio Companies

Canaan’s value-add capabilities have significantly benefited its portfolio companies. For instance, Canaan’s network and strategic guidance have contributed to 73 IPOs and 152 M&A transactions, underscoring their role in helping companies achieve major milestones. Founders have testified to the transformative impact of Canaan’s involvement, with some stating that the firm made them “a better company” even before formal investment.

In conclusion, Canaan Partners’ commitment to supporting growth and innovation is evident in their comprehensive support offerings, which include strategic mentorship, operational expertise, and a robust networking framework. This holistic approach positions Canaan as a pivotal partner for startups aiming to scale and succeed in competitive markets.

This HTML content objectively outlines Canaan Partners' value-add capabilities, focusing on mentorship, support programs, and the impact on portfolio companies. The structured format and use of specific data points enhance the content's clarity and relevance for SEO purposes.Application Process and Timeline

Entrepreneurs seeking investment from Canaan Partners can expect a structured application process. Below are the key steps and timeline to guide you:

Steps in the Application Process

- Initial Contact: Connect with Canaan Partners by sending a tailored email application.

- Documentation Submission: Provide a PDF resume, links to professional profiles, and a brief written response on your sector enthusiasm and selected startup interest.

- Warm Introductions: If possible, arrange introductions through contacts who know Canaan team members.

- Follow-up: Upon submission, expect a prompt response regarding the next steps.

Typical Timeline

The application process duration varies but typically involves a prompt initial response. Further steps depend on the specific role and applicant's background.

Documentation Requirements

- Resume (PDF): Essential for all applicants.

- Professional Profile Links: Include LinkedIn, Twitter, Medium, etc.

- Written Response: A concise, half-page maximum response detailing your passion for a technology sector and interest in an early-stage company.

- Healthcare Roles: Additional requirements like a CV, scientific credentials, and due diligence experience.

Adhering to these guidelines will ensure a smooth application process with Canaan Partners, helping you move closer to securing investment for your venture.