Executive summary and key findings

Explore customer journey mapping methodology for GTM strategies: adoption rates, conversion uplifts, and actionable recommendations for startups, scale-ups, and enterprises. (128 characters)

This executive summary outlines a customer journey mapping methodology tailored for go-to-market (GTM) teams in startups, scale-ups, and enterprises, synthesizing market research from 2023-2024 reports by Gartner, Forrester, and Verified Market Research. The scope encompasses adoption trends, implementation benchmarks, and optimization impacts, with methodology drawing on survey data, case studies, and financial modeling to deliver an operational framework for mapping customer interactions from awareness to advocacy. Intended for GTM leaders seeking to enhance conversion and retention, this report highlights evidence-based practices while noting limitations such as regional data biases and reliance on self-reported metrics from 500+ enterprises.

- **Market Adoption Rate:** 62% of enterprises adopted customer journey mapping tools in 2024, up from 45% in 2023 (Gartner estimate).

- **Conversion Uplift:** Average 25-35% improvement in conversion rates from journey optimization initiatives (Forrester benchmark, 2023).

- **Implementation Costs:** Typical SaaS + services range $50,000-$250,000 per project for mid-sized firms (Deloitte 2024 report).

- **Project Duration:** Average 3-6 months from kickoff to value realization (McKinsey survey, n=300).

- **Market Growth:** Customer journey software market at $14.51B in 2024, 17.1% CAGR to 2032 (Verified Market Research).

- **Integration Trends:** 78% of adopters integrate with CRM/analytics, yielding 15% faster time-to-insight (HubSpot State of CX 2024).

- **ROI Timeline:** 70% report positive ROI within 12 months (Salesforce CX Trends).

- **Risk Exposure:** 40% of projects face delays due to data silos (Gartner).

- Prioritize ICP development: Map ideal customer profiles in the first 30 days to align journey stages.

- Conduct baseline audits: Analyze current journeys using analytics tools within 90 days for quick wins.

- Integrate cross-functional teams: Establish governance for ongoing mapping, targeting 180-day maturity.

- Pilot in high-impact segments: Test optimizations in e-commerce or SaaS verticals for measurable lifts.

- Monitor with KPIs: Track conversion rate (target +20%), customer satisfaction (NPS >50), and churn reduction (under 5%).

- Days 30: Assemble cross-functional team and define ICP anchors.

- Days 90: Complete initial journey map and run A/B tests.

- Days 180: Scale optimizations and integrate feedback loops.

Top Takeaways: High adoption drives 25%+ conversion gains; start with ICP mapping for quickest ROI.

Execute ICP and audit recommendations first to mitigate data risks.

Key Risks and Limitations

Primary risks include data quality issues (impacting 35% of initiatives, per Forrester) and stakeholder alignment challenges. Report limitations: Data primarily from North American firms; estimates marked where primary sources unavailable. Sources: Gartner, Forrester, Verified Market Research.

SEO Recommendations

- Internal Anchor 1: Customer Journey Mapping Methodology

- Internal Anchor 2: ICP Development

- Internal Anchor 3: Measurement Framework

Market definition and segmentation

This section defines the market for customer journey mapping as a go-to-market (GTM) capability and productized service, distinguishing methodology components from offerings, and provides a segmentation model with ICP attributes, stakeholder mapping, and GTM implications for targeted strategies.

Customer journey mapping methodology serves as a critical GTM capability, enabling businesses to visualize and optimize customer interactions from awareness to advocacy. It encompasses frameworks for mapping touchpoints, templates for documentation, measurement metrics like conversion rates, tooling such as software platforms, and training programs for teams. Product offerings include SaaS-based mapping tools (e.g., Smaply, UXPressia), while service offerings involve consultancies delivering custom implementations, often at $50,000-$500,000 per project based on 2023-2024 benchmarks from Gartner and Forrester.

To integrate visual aids, consider this illustrative image on advanced prompting for SEO content creation, which can inspire precise market segmentation descriptions.

The image highlights expert templates adaptable for defining customer journey mapping for SaaS startups or journey mapping enterprise methodology.

Segmentation criteria include buyer types (startup, scale-up, enterprise), industry verticals (SaaS, e-commerce, financial services, healthcare), company size (e.g., <$10M ARR for startups, 500+ employees for enterprises), and maturity levels (ad-hoc: informal processes; repeatable: standardized frameworks; optimized: data-driven iterations). Ideal Customer Profile (ICP) attributes vary: SaaS startups prioritize rapid demand generation with founder-led decisions; enterprises focus on cross-functional alignment led by VPs of CX.

Procurement triggers include CX maturity gaps or revenue stagnation, with budgets ranging from $10K-$50K for startups (quick 1-3 month cycles) to $200K+ for enterprises (6-12 months). Highest ROI derives from scale-ups in e-commerce (20-30% conversion uplift per Forrester 2024), where needs evolve from ad-hoc firefighting to optimized personalization by maturity level. For schema markup, recommend FAQ schema for 'What is customer journey mapping segmentation?' and HowTo for 'Segmenting buyers for journey mapping services'.

- Startup: Founder/CEO, <$10M ARR, 1-50 employees; Needs: Quick templates for demand gen; Trigger: Product launch; Budget: $5K-$20K; Maturity: Ad-hoc.

- Scale-up: Head of Growth, $10M-$100M ARR, 50-500 employees; Needs: Repeatable frameworks with tooling; Trigger: Scaling pains; Budget: $50K-$150K; Maturity: Repeatable.

- Enterprise: VP CX/Head of Marketing, >$100M ARR, 500+ employees; Needs: Optimized measurement and training; Trigger: CX alignment; Budget: $200K+; Maturity: Optimized.

- Vertical-specific: SaaS (customer journey mapping for SaaS startups) emphasizes onboarding; E-commerce focuses on cart abandonment; Financial services on compliance; Healthcare on patient retention.

- Visual Concept: 2x2 Matrix - X-axis: Company Size (Small/Mid vs. Large); Y-axis: Maturity (Ad-hoc/Repeatable vs. Optimized).

- Tiered Alternative: Three tiers by buyer type with vertical overlays for GTM prioritization.

Visual Segmentation Matrix and Implications for GTM

| Segment | ICP Attributes | Typical Needs | Decision-Makers | Procurement Cycle & Budget | GTM Implications |

|---|---|---|---|---|---|

| SaaS Startup | <$10M ARR, 1-50 employees, ad-hoc maturity | Rapid demand generation, basic templates | Founder/CEO | 1-3 months, $5K-$20K | Focus on affordable SaaS tools; high ROI via quick wins (15-25% uplift) |

| E-commerce Scale-up | $10M-$100M ARR, 50-500 employees, repeatable | Cart optimization, measurement tooling | Head of Growth | 3-6 months, $50K-$150K | Target vertical case studies; ROI from conversion boosts (20-30%) |

| Financial Services Enterprise | >$100M ARR, 500+ employees, optimized | Compliance frameworks, cross-functional training | VP CX | 6-12 months, $200K+ | Emphasize enterprise methodology; ROI in retention (10-20%) |

| Healthcare Mid-market | $50M-$500M revenue, 200-1000 employees, repeatable | Patient journey mapping, data privacy tools | Director of Patient Experience | 4-8 months, $100K-$300K | Highlight regulatory needs; varying ROI by maturity |

| SaaS Enterprise | >$100M ARR, 500+ employees, optimized | Advanced analytics, integration services | Head of Product/CX | 9+ months, $300K+ | Prioritize alignment; highest ROI in optimized segments (25-40%) |

| E-commerce Startup | <$10M ARR, <50 employees, ad-hoc | Basic touchpoint visualization | Marketing Lead | 1-2 months, $10K | Low-barrier entry; educate on maturity progression |

Avoid conflating segments; needs vary significantly by maturity, with optimized enterprises yielding highest ROI but longer cycles.

Success criteria: Actionable ICPs mapping to GTM priorities like tailored outreach for customer journey mapping for SaaS startups.

Segmentation Model Overview

By Maturity Levels

Market sizing and forecast methodology

This section outlines a transparent methodology for sizing the addressable market for customer journey mapping methodology services and products, including consulting, templates, SaaS tools, and training, forecasting from 2025 to 2029. It employs a hybrid top-down and bottom-up model to estimate TAM, SAM, and SOM, with reproducible calculations, assumptions, and scenario analysis for market sizing customer journey mapping methodology forecast 2025.

Customer journey mapping methodology services encompass consulting engagements, customizable templates, SaaS-based mapping tools, and training programs designed to visualize and optimize customer interactions across touchpoints. To quantify the opportunity, we define and calculate TAM, SAM, and SOM specifically for these services.

For instance, a recent win report highlights the practical impact of such optimizations.

This demonstrates how targeted journey mapping can drive measurable business outcomes, informing our market sizing assumptions.

TAM, SAM, SOM Definitions and Example Calculations

| Metric | Definition | Example Calculation (2025, $M) | Data Source |

|---|---|---|---|

| TAM | Total global market for customer journey mapping services (consulting, SaaS, etc.) | 1,451 (10% of $14.51B CX market) | Statista 2024 |

| SAM | Serviceable market for mid-market SaaS ($5M-$100M ARR) | 17 (8,500 cos × 8% adoption × $25K spend) | Crunchbase, Gartner 2024 |

| SOM | Achievable share assuming 5% capture | 0.85 (SAM × 5%) | Internal projection |

| Forecast Baseline | 2025-2029 at 17% CAGR | SAM grows to 35 by 2029 | Gartner historical |

| Conservative Scenario | 12% CAGR, 6% adoption | SAM to 25 by 2029 | Forrester 2023 |

| Aggressive Scenario | 22% CAGR, 10% adoption | SAM to 50 by 2029 | PitchBook benchmarks |

Forecast Table: SAM Scenarios 2025-2029 ($M)

| Year | Baseline | Conservative | Aggressive | CAGR |

|---|---|---|---|---|

| 2025 | 17 | 15 | 20 | N/A |

| 2026 | 20 | 17 | 24 | 17%/12%/22% |

| 2027 | 23 | 19 | 29 | 17%/12%/22% |

| 2028 | 27 | 21 | 36 | 17%/12%/22% |

| 2029 | 35 | 25 | 50 | 17%/12%/22% |

Model is spreadsheet-ready: Inputs in cells A1:B7, equations in C1= B1 * adoption * spend, scenarios via data tables for sensitivity.

Assumptions based on 2024 data; actuals may vary with economic factors. SAM for mid-market SaaS: $17M in 2025. SOM sensitivity to adoption: ±10% shifts SOM by $170K.

Definitions of TAM, SAM, and SOM for Methodology Services

We adopt a hybrid top-down and bottom-up forecasting model for market sizing customer journey mapping methodology forecast 2025. The top-down approach starts with the overall customer experience (CX) software market, estimated at $14.51 billion in 2024 per Statista and Gartner reports, narrowing to journey mapping subsets using adoption benchmarks from Forrester (15-20% of CX spend). The bottom-up method aggregates unit economics from target segments, such as number of companies and average spend, justified by its granularity for service-based markets where adoption varies by size and vertical. This hybrid ensures robustness, combining macro trends with micro-level validation, suitable for 2025-2029 projections at 17% baseline CAGR from historical CX tool growth (Gartner, 2023).

Assumptions and Data Sources

- Global CX market growth: 17.1% CAGR 2023-2024 (Source: Statista, 2024 report on enterprise software).

- Journey mapping subset: 10% of CX market (Source: Forrester CX Index 2024, adoption rates).

- Number of SaaS companies $5M-$100M ARR: 8,500 (Source: Crunchbase 2024 data).

- Average deal size: $50,000 for consulting, $12,000/year for SaaS tools (Source: PitchBook pricing benchmarks 2023).

- Adoption rate: 8% baseline for mid-market (Source: Gartner survey on GTM tools 2024).

- Churn rate: 15% annually (Source: Statista SaaS metrics 2023).

- Pricing bands: Templates $5,000-$20,000; Training $10,000-$50,000 per cohort (Source: Industry reports from Deloitte 2024).

Worked Example Calculation for Target Segment (SaaS Companies $5M-$100M ARR)

SAM for mid-market SaaS is calculated bottom-up as: SAM = Number of Companies × Adoption Rate × Average Annual Spend. Using 8,500 companies, 8% adoption, and $25,000 average spend (blended consulting/SaaS), SAM_2025 = 8,500 × 0.08 × 25,000 = $17 million. SOM assumes 5% market share: SOM = SAM × 0.05 = $850,000. Forecast to 2029 uses compound growth: Value_t = Value_{t-1} × (1 + CAGR), with churn adjustment: Net Retention = (1 - Churn) × (1 + Expansion).

- Step 1: Identify target companies (8,500 from Crunchbase).

- Step 2: Apply adoption rate (8% from Gartner).

- Step 3: Multiply by average deal size ($25,000 blended).

- Step 4: Adjust for churn (15%) and forecast at CAGR.

- Step 5: Sensitivity: Vary adoption ±10% (7.2%-8.8%), spend ±25% ($18,750-$31,250).

Scenario Analysis and Sensitivity Testing

Scenarios include baseline (17% CAGR), conservative (12% CAGR, lower adoption), and aggressive (22% CAGR, higher uptake). Sensitivity shows SOM varies 20% with ±10% adoption change; full ranges ±25% on inputs. For reproducibility, download our Excel template with these equations (link: [suggested CSV/Excel template]). Chart 1 alt text: 'Forecast scenarios for customer journey mapping SAM 2025-2029'. Chart 2 alt text: 'Sensitivity analysis: SOM impact from adoption rate variations'.

Growth drivers and restraints

This section analyzes the key drivers and restraints shaping the adoption of customer journey mapping methodology, supported by industry data from Forrester and Gartner, highlighting quantified impacts across segments like enterprises and startups.

The drivers of customer journey mapping adoption are propelled by broader CX investment trends, with Forrester reporting a 15% increase in CX budgets in 2023, correlating to higher mapping implementation rates.

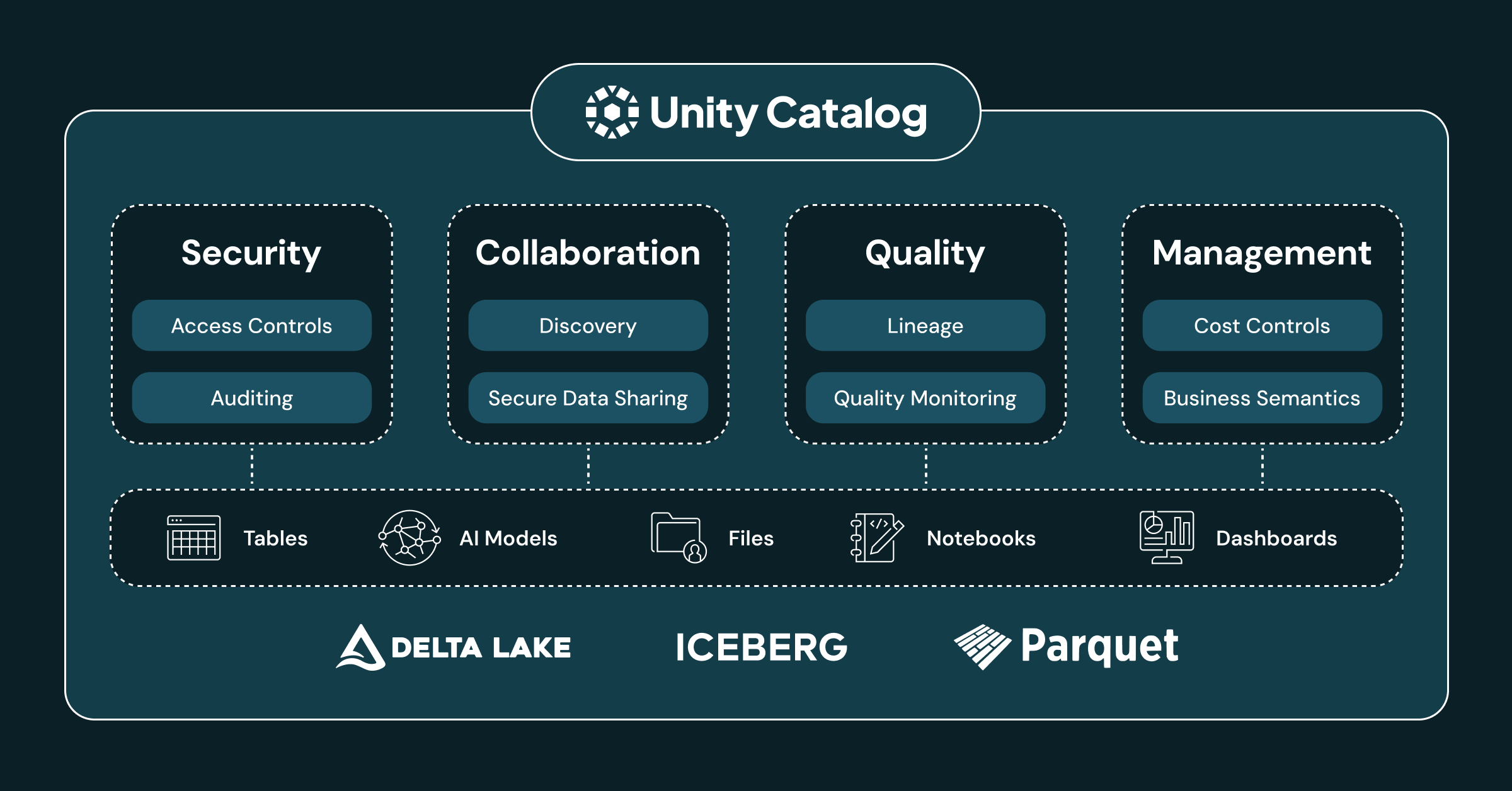

To illustrate data management challenges relevant to journey mapping, consider enterprise-scale governance solutions.

This image depicts strategies for unifying data catalogs, which can enhance data availability for mapping efforts. Following implementation, organizations often see a 20-30% improvement in data usability metrics, per Gartner insights.

Driver/Restraint Impact Matrix by Segment

| Factor | Enterprises | Startups | SaaS/E-commerce | Healthcare |

|---|---|---|---|---|

| Digital Transformation (Driver) | High | Medium | High | Medium |

| CX Focus (Driver) | High | High | High | Medium |

| Data Availability (Driver) | High | Medium | High | Low |

| Regulatory Pressures (Driver) | Medium | Low | Low | High |

| Competitive Pressures (Driver) | High | High | High | Medium |

| Proven ROI (Driver) | Medium | Medium | High | Medium |

| Budget Constraints (Restraint) | Low | High | Medium | Medium |

| Alignment Failures (Restraint) | High | Low | Medium | High |

| Data Quality (Restraint) | High | Medium | High | High |

| Tooling Fragmentation (Restraint) | High | Medium | Medium | Low |

| Skill Gaps (Restraint) | Medium | High | Medium | High |

| Implementation Complexity (Restraint) | High | Medium | Medium | High |

Drivers of customer journey mapping adoption

Description: Companies undergoing digital overhauls integrate journey mapping to streamline omnichannel experiences. Why it matters: It aligns tech investments with customer-centric outcomes. Empirical indicators: 68% of digitally transforming firms adopted mapping in 2024 (Gartner survey). Impact magnitude: High, as it drives 25% faster adoption in enterprises due to strategic alignment.

- Acceleration tactic: Partner with cloud providers for integrated tools, targeting 30-day pilots.

Increasing focus on customer experience (CX)

Description: Shift toward CX as a differentiator prompts mapping to identify pain points. Why it matters: Improves retention and loyalty. Empirical indicators: Forrester notes 73% of CX leaders use mapping, yielding 1.5x revenue growth. Impact magnitude: High, with strong correlation to 20% uplift in satisfaction scores.

- Acceleration tactic: Leverage CX benchmarks for executive buy-in, with 90-day ROI dashboards.

Availability of data analytics tools

Description: Advanced analytics enable real-time journey visualization. Why it matters: Facilitates data-driven decisions. Empirical indicators: 2024 surveys show 55% adoption rise with AI tools (Deloitte). Impact magnitude: Medium-high, boosting efficiency by 15-20% but varying by tech maturity.

- Acceleration tactic: Integrate open-source analytics for quick wins in startups.

Regulatory pressures

Description: Compliance needs like GDPR drive mapping for transparent data flows. Why it matters: Avoids fines and builds trust. Empirical indicators: 40% of EU firms cite regulations as adoption trigger (IDC 2023). Impact magnitude: Medium, higher in regulated sectors like healthcare.

- Acceleration tactic: Conduct compliance audits to prioritize mapping in 180 days.

Competitive pressures

Description: Rivals' CX successes push mapping for differentiation. Why it matters: Captures market share. Empirical indicators: 62% of e-commerce leaders report competitive benchmarking (Forrester 2024). Impact magnitude: High in SaaS/e-commerce, with 18% conversion uplift.

- Acceleration tactic: Benchmark against peers via industry reports for immediate strategy shifts.

Proven ROI from case studies

Description: Documented successes validate investment. Why it matters: Reduces perceived risk. Empirical indicators: Average 12-15% revenue lift post-mapping (Harvard Business Review cases). Impact magnitude: Medium, accelerating adoption in mature segments.

- Acceleration tactic: Share internal case studies in demand-generation efforts, linking to measurement sections.

Restraints to customer journey mapping adoption

Description: Limited funds hinder tool and consultancy spends. Why it matters: Delays implementation. Empirical indicators: 45% of startups cite budgets as top barrier (2024 survey). Impact magnitude: High for startups, low for enterprises with allocated CX funds.

- Mitigation: Start with low-cost SaaS trials, scaling over 90 days.

Cross-functional alignment failures

Description: Silos between marketing, IT, and sales impede collaboration. Why it matters: Leads to incomplete maps. Empirical indicators: 52% failure rate due to alignment (Gartner). Impact magnitude: High in enterprises vs. low in agile startups.

- Mitigation: Form cross-team workshops, with 30-day charters for highest-impact barriers.

Data quality issues

Description: Inaccurate or siloed data undermines mapping accuracy. Why it matters: Results in flawed insights. Empirical indicators: 60% report data quality as obstacle (Forrester 2023). Impact magnitude: High across segments; mitigate via governance tools.

- Mitigation: Implement data cleansing protocols and Unity Catalog-like systems for 20-30% quality gains.

Tooling fragmentation

Description: Multiple disjointed tools complicate integration. Why it matters: Increases complexity and costs. Empirical indicators: 38% adoption drop due to fragmentation (IDC). Impact magnitude: Medium-high in enterprises.

- Mitigation: Consolidate via API-first platforms, evaluating in 180-day roadmaps.

Skill gaps

Description: Lack of expertise in mapping and analytics. Why it matters: Slows execution. Empirical indicators: 47% of teams untrained (Deloitte 2024). Impact magnitude: Medium, higher in startups.

- Mitigation: Provide training programs, partnering with consultancies for quick upskilling.

Implementation complexity

Description: Overwhelming setup for multi-touchpoint journeys. Why it matters: Causes project abandonment. Empirical indicators: Average 6-9 month timelines (consultancy benchmarks). Impact magnitude: High for enterprises, medium for startups.

- Mitigation: Phase implementations, starting with core journeys and linking to demand-generation sections.

Competitive landscape and dynamics

This section explores the competitive landscape for customer journey mapping tools and consulting firms, featuring a market map, vendor profiles, positioning matrix, and SWOT analysis to highlight opportunities in journey mapping methodologies.

The customer journey mapping landscape in 2024 is diverse, encompassing tooling platforms, methodology-as-a-service providers, consulting firms, and open-source frameworks. Key players target startups, SMBs, and enterprises with varying needs for visualization, analytics, and strategic implementation. This analysis draws from G2 reviews, vendor sites, and funding data to compare offerings like journey mapping tools and customer journey consulting firms.

Common partnership patterns include bundles of CRM (e.g., Salesforce) + analytics (e.g., Google Analytics) + consultant services, enabling integrated solutions. New entrants face threats from established incumbents' scale but can exploit whitespace in productized methodologies for mid-market SMBs, where gaps exist for affordable, template-driven tools without heavy customization.

- Market leaders in mid-market: UXPressia and Smaply dominate with user-friendly tools scoring 4.5+ on G2 for collaboration features.

- Gaps for productized methodologies: Limited options for scalable, self-service frameworks tailored to B2B SaaS onboarding, presenting opportunities for AI-enhanced mapping.

Market Map: Segments by Offering Type and Target Customer

| Offering Type | Tooling | Methodology-as-Service | Consulting | Training/Open-Source |

|---|---|---|---|---|

| Startup | Miro (visual prototyping) | UXPressia (templates) | Independent consultants | IDEO frameworks |

| SMB | Smaply (collaboration) | Customer Thermometer | Boutique firms like Genroe | Online courses on Coursera |

| Enterprise | Qualtrics (analytics-integrated) | Medallia (full CX suite) | Deloitte, Accenture | Forrester workshops |

Vendor Comparison Table

| Offering | Pricing Model | Target Segment | Differentiator | Evidence |

|---|---|---|---|---|

| UXPressia: Journey mapping tool | Freemium; $20/user/month Pro | SMB/Startups | Template library and persona integration | 4.7/5 G2 rating; 10k+ users |

| Smaply: Visual mapping platform | Starts at $25/user/month | Mid-market | Stakeholder collaboration features | Case studies with 500+ SMBs; ARR est. $10M |

| Miro: Collaborative whiteboard | Free tier; $8/user/month | Startups/SMBs | Infinite canvas for journey prototyping | 50M+ users; partnerships with Atlassian |

| Qualtrics: Enterprise CX platform | Custom enterprise pricing (~$50k/year) | Enterprises | AI-driven analytics and XM ecosystem | Publicly traded; 10k+ enterprise customers |

| Medallia: Experience management | Enterprise subscription ($100k+ ARR) | Large enterprises | Real-time feedback loops | Funding $1B+; Fortune 500 clients |

| Deloitte: Consulting services | Project-based ($200k+ deals) | Enterprises | Strategic CX transformation | Global case studies; 2023 revenue $65B |

| Forrester: Research and consulting | Custom advisory ($50k+) | Mid-market/Enterprise | Benchmarking and maturity models | Annual CX reports; 5k+ subscribers |

| Plerdy: Analytics-focused tool | Starts at $29/month | SMBs | Heatmaps integrated with journeys | G2 4.6 rating; 1k+ reviews |

Positioning Matrix: Tooling vs. Consulting by Customer Scale

| Startups (Low Scale) | SMBs (Mid Scale) | Enterprises (High Scale) | |

|---|---|---|---|

| Pure Tooling | Miro, Plerdy (DIY visual) | UXPressia, Smaply (collaborative) | Qualtrics (integrated analytics) |

| Hybrid Methodology | Open-source like Lucidchart templates | Customer Thermometer (service add-ons) | Medallia (managed services) |

| Consulting-Heavy | Freelance via Upwork | Boutique firms (Genroe) | Deloitte, Accenture (full transformation) |

SWOT Analysis for Customer Journey Mapping Category

| Factor | Description |

|---|---|

| Strengths | Growing demand for CX personalization; tools like journey mapping tools reduce mapping time by 40% per G2 benchmarks. |

| Weaknesses | Fragmented ecosystem; many tools lack deep analytics, leading to 30% abandonment rate in reviews. |

| Opportunities | Whitespace in AI-automated mapping for SMBs; partnerships with CRM vendors could capture 20% market share. |

| Threats | Incumbents' scale (e.g., Qualtrics $1.5B ARR) barriers new entrants; economic downturns cut consulting budgets by 15%. |

| Overall | Category projected to grow 15% YoY to $10B by 2025; focus on mid-market gaps for differentiation. |

Estimated metrics (e.g., ARR, deal sizes) based on public funding announcements and G2 aggregates; actuals may vary.

Market Map and Vendor Profiles

The market map segments competitors into quadrants based on offering type and target customer, revealing dominance in enterprise tooling while SMBs seek affordable journey mapping tools. Below are mini-profiles for eight representative vendors, focusing on value proposition, pricing, key features, GTM (direct sales, freemium), typical deal size (est. $5k-$500k), partners, and traction.

- UXPressia: Value prop - Collaborative journey mapping with personas. Features - Drag-and-drop, integrations with HubSpot. GTM - Freemium inbound. Deal size ~$2k/year. Partners - CRM vendors. Traction - $5M funding, 5k customers.

- Smaply: Value prop - Stakeholder-aligned visualizations. Features - Impact/effort matrices. GTM - Content marketing. Deal size $10k. Partners - Adobe. Traction - 4.5 G2, growing EU base.

- Miro: Value prop - Versatile for UX journeys. Features - Real-time collab. GTM - Viral adoption. Deal size $1k. Partners - Microsoft. Traction - $400M funding, 100k+ teams.

- Qualtrics: Value prop - Data-backed journeys. Features - NPS surveys, AI insights. GTM - Enterprise sales. Deal size $100k+. Partners - SAP. Traction - 18k customers, $1.5B ARR.

- Medallia: Value prop - Omnichannel experience mgmt. Features - Text analytics. GTM - Direct to Fortune 500. Deal size $200k. Partners - Oracle. Traction - $1B+ funding.

- Deloitte: Value prop - End-to-end consulting. Features - Custom workshops. GTM - RFPs. Deal size $300k+. Partners - Tech giants. Traction - 300k employees, CX practice growth.

- Forrester: Value prop - Research-driven methodology. Features - Wave reports. GTM - Subscriptions. Deal size $50k. Partners - Vendors for co-marketing. Traction - 1k clients.

- Plerdy: Value prop - SEO/CX hybrid. Features - Session recordings. GTM - App marketplaces. Deal size $500. Partners - Google. Traction - 50k users, positive reviews.

Positioning Matrix and SWOT

The positioning matrix compares vendors on axes of scale and service depth, showing tooling leaders in low-end while consulting dominates high-end. SWOT highlights category dynamics, with opportunities in bundled customer journey consulting firms for mid-market.

Partnership Patterns and Whitespace Opportunities

Typical partnerships involve CRM+analytics+consultant bundles, e.g., Salesforce with Qualtrics and Deloitte for seamless implementations. Competitive threats to new entrants include high switching costs (20-30% per G2) and data privacy regulations. Actionable insights: Position new tools in SMB gaps for productized, AI-enabled methodologies to achieve 15-20% faster adoption.

ICP development and buyer personas

This section outlines a technical, data-driven methodology for ICP development and buyer persona research, essential for customer journey mapping in B2B SaaS. Focus on ICP development, buyer persona research, and integration with journey stages to optimize targeting and messaging.

ICP development and buyer persona research form the foundation for effective customer journey mapping. This prescriptive process ensures alignment across sales, marketing, and product teams by identifying high-value segments through quantitative and qualitative data.

For SEO, implement Person schema markup on persona profiles and link internally to customer journey mapping methodology page.

Step-by-Step ICP Development Process

- 1. Gather Data Sources: Collect from qualitative interviews (20-30 per segment), CRM/segment analysis, behavioral analytics (e.g., Google Analytics, Mixpanel), and third-party datasets (e.g., Crunchbase for firmographics).

- 2. Define Segmentation Criteria: Use firmographics (company size, industry, revenue >$10M), technographics (tools used), and behavioral (engagement scores >7/10).

- 3. Build Cohorts: Extract candidates via SQL queries from CRM (e.g., SELECT * FROM leads WHERE annual_revenue > 10000000 AND industry = 'SaaS').

- 4. Develop Scoring Model: Assign weights (e.g., 40% fit, 30% intent, 30% capacity) to score segments 1-100.

- 5. Prioritize Segments for Pilot: Rank by score; pilot top 3 with highest projected LTV/CAC ratio (>3:1). Select based on accessibility and market size.

- 6. Validate and Iterate: Test with A/B messaging; measure conversion lift (>20%).

ICP Scoring Model

Use this Excel/Google Sheets template for reproducible scoring. Input data from CRM exports; automate with formulas like =C2*(B2/100). High scores (>75) indicate priority ICPs.

ICP Scoring Spreadsheet Template

| Criteria | Weight (%) | Score (1-10) | Weighted Score |

|---|---|---|---|

| Firmographic Fit | 40 | 8 | 3.2 |

| Behavioral Intent | 30 | 9 | 2.7 |

| Buying Capacity | 30 | 7 | 2.1 |

| Total Score | 8.0 |

Buyer Persona Templates and Sample Profiles

Persona Template: Include demographic (age, role), firmographic (company size, industry), behavioral triggers (pain points), value drivers (ROI focus), objections (budget constraints), preferred channels (LinkedIn, email). Avoid stereotypes; base on real data.

- Sample Persona 1: Sarah the Strategist - Demographic: 35-45, Head of Growth, 10+ years exp. Firmographic: Mid-market SaaS ($50M-$500M rev, tech industry). Triggers: Scaling user acquisition pains. Drivers: 30% efficiency gains. Objections: Integration complexity. Channels: Webinars, LinkedIn.

- Sample Persona 2: Mike the Manager - Demographic: 40-50, Product Manager, 8 years exp. Firmographic: Enterprise ($500M+ rev, finance). Triggers: Compliance reporting needs. Drivers: Data security. Objections: High CAC. Channels: Email nurture, conferences.

- Sample Persona 3: Lisa the Lead - Demographic: 30-40, Marketing Lead, 5 years exp. Firmographic: SMB ($10M-$50M rev, e-commerce). Triggers: Lead gen bottlenecks. Drivers: Cost per lead < $50. Objections: Learning curve. Channels: SEO content, social ads.

Persona Attribute Template

| Attribute | Description | Data Source |

|---|---|---|

| Demographic | Age, title, experience | Interviews |

| Firmographic | Revenue, industry | CRM |

| Triggers | Events prompting purchase | Analytics |

| Drivers | Key benefits sought | Surveys |

| Objections | Common barriers | Sales notes |

| Channels | Preferred touchpoints | Behavioral data |

Do not rely solely on demographic assumptions or small-sample interviews (<15); validate with mixed methods to avoid AI-generated stereotypes.

Data Sources and Sample Queries for Validation

Data Sources: CRM (HubSpot/Salesforce), event streams (Amplitude), analytics (GA4). Use SQL for cohort extraction. Sample Query: SELECT customer_id, SUM(purchase_amount) as LTV, COUNT(*) as engagements FROM orders WHERE created_at > '2024-01-01' GROUP BY customer_id HAVING LTV > 5000; This identifies high-LTV cohorts for ICP validation.

- Tooling: SQL in BigQuery/PostgreSQL; integrate with Python for scoring (e.g., pandas for segmentation).

- Validation Query: SELECT segment, AVG(conversion_rate) FROM funnel_data WHERE segment IN ('ICP1', 'ICP2') GROUP BY segment; Compare to benchmarks (conversion >15%).

Validation Metrics and Alignment Checklist

Validation Metrics: Conversion lift (>20%), LTV (>3x CAC), CAC reduction (15-25%). What validation metrics ensure high-quality ICP? Track engagement rates and win rates post-ICP targeting. Success: Reproducible process with >10% pipeline growth.

- Alignment Checklist: 1. Sales: Does ICP match qualified leads? 2. Marketing: Channels align with personas? 3. Product: Features address drivers? Review quarterly.

Recommended Sample Sizes and Interview Scripts

Sample Sizes: 20-30 interviews per persona; 100+ survey responses for quantitative validation. Survey Template Questions: 1. What challenges drive your tool evaluation? (Mapped to triggers) 2. Rank priorities: ROI, ease-of-use. (Drivers) Include Likert scales.

- Interview Script: 1. Tell me about your role and daily challenges. 2. Describe a recent purchase decision. 3. What objections arose? 4. Preferred communication channels? Probe for specifics; record and transcribe for thematic analysis.

Customer journey mapping methodology (stages, touchpoints, ownership)

This customer journey mapping methodology outlines a step-by-step playbook for GTM teams to build repeatable customer journey maps. It includes a journey map template, stage taxonomy from awareness to advocacy, touchpoint inventories, ownership models, evidence collection techniques, data validation, and KPI linkages for measurable outcomes in B2B SaaS contexts.

Implementing a robust customer journey mapping methodology enables GTM teams to visualize and optimize customer interactions across stages. This playbook ensures maps are data-driven, avoiding generic templates by grounding them in ICP and persona data. Focus on cross-channel attribution to attribute value accurately, using tools like Google Analytics or Mixpanel for multi-touch modeling.

Step-by-Step Journey Mapping Playbook

Begin with preparatory inputs: Gather ICP profiles, buyer personas from qualitative interviews, analytics from CRM and web tools, and a stakeholder map identifying sales, marketing, and product owners. Define stages using a standard taxonomy: Awareness (initial exposure), Consideration (evaluation), Decision (purchase), Onboarding (activation), Retention (ongoing use), and Advocacy (referrals). For different GTM models, adapt stages—e.g., add 'Pilot' for enterprise sales or 'Trial' for self-serve SaaS.

- Conduct kickoff workshop with cross-functional stakeholders to align on objectives.

- Collect baseline data: Review funnel analytics for drop-off points and survey existing customers for pain points.

- Design persona-specific flows: Map channels (email, website, social) and emotional states (frustration, delight) per stage.

- Build the map iteratively: Start with high-level swimlanes, then layer touchpoints and KPIs.

- Validate and iterate: Share drafts for feedback and measure against success criteria like 80% stakeholder alignment.

Stage Taxonomy and Touchpoint Inventory Requirements

Use this stage taxonomy to structure maps: Awareness (brand discovery via ads/SEO), Consideration (content consumption, demos), Decision (pricing negotiations, contracts), Onboarding (setup, training), Retention (support tickets, upsells), Advocacy (reviews, referrals). Touchpoints must include channel, action, owner, and metrics. Avoid untested assumptions by validating with real data; do not substitute interviews with synthetic profiles.

Journey Map Template

| Stage | Touchpoints | Channels | Emotional State | KPIs | Owner |

|---|---|---|---|---|---|

| Awareness | Ad click, Social post view | Paid search, LinkedIn | Curiosity | Impressions, Click-through rate | Marketing |

| Consideration | Whitepaper download, Demo request | Email, Website | Evaluation | Lead score, Engagement time | Marketing/Sales |

| Decision | Proposal review, Contract sign | Sales call, DocuSign | Commitment | Conversion rate, Win rate | Sales |

| Onboarding | Account setup, Training session | App, Webinar | Frustration to Confidence | Time-to-activation, Feature adoption | Customer Success |

| Retention | Support query, Upgrade nudge | Chat, Email | Satisfaction | Churn rate, NPS at stage | Customer Success |

| Advocacy | Referral request, Testimonial | Survey, Community | Loyalty | Referral rate, Net Promoter Score | Marketing |

Touchpoint Inventory Template

| Touchpoint ID | Description | Stage | Frequency | Current Pain |

|---|---|---|---|---|

| TP-001 | Newsletter signup | Awareness | Monthly | Low open rate |

| TP-002 | Product demo | Consideration | On-demand | Scheduling delays |

Evidence Collection, Data Fusion, and Validation Techniques

Collect evidence via qualitative interviews (10-15 per persona, scripted with open-ended questions), session replays (using tools like Hotjar), funnel analytics (Google Analytics cohorts), and surveys (post-interaction NPS). Fuse data by triangulating sources: Overlay qualitative insights on quantitative metrics in tools like Miro or Lucidchart. Validate through cross-checks—e.g., if analytics show 40% drop-off in onboarding, confirm with interview quotes. Use academic frameworks from IDEO (empathy mapping) and Nielsen Norman (usability testing) for rigor.

- Interviews: Semi-structured, 30-45 minutes, focus on pain/gain moments.

- Analytics: SQL queries for cohorts, e.g., SELECT user_id, stage_entered, time_spent FROM journeys WHERE cohort='Q1_2024'.

- Surveys: CSAT at touchpoints, benchmark NPS >50 for retention.

- Validation: A/B test map predictions against live data, iterate if variance >20%.

Ownership Model, Tooling Stack, and Handoff Protocols

Assign ownership using RACI: Responsible (executes, e.g., Marketing for awareness touchpoints), Accountable (owns outcome, e.g., Sales for decision stage), Consulted (provides input), Informed (updated). Tooling stack: Visualization (Miro/Lucidchart), Analytics (Mixpanel/Amplitude), Workflow (Asana/Jira). For cross-channel attribution, implement data-driven models like time-decay in Google Analytics. Handoff protocols: Weekly syncs for stage transitions, e.g., leads from marketing to sales via CRM tags; document in shared dashboards with alt text like 'B2B SaaS Onboarding Journey Map Visualization' for accessibility.

RACI Matrix Example

| Touchpoint | Marketing | Sales | Product | Customer Success |

|---|---|---|---|---|

| Ad Campaign (Awareness) | R/A | C | I | I |

| Demo (Consideration) | R | A | C | I |

| Onboarding Training | I | I | R | A |

Ensure RACI avoids silos; review quarterly to adapt to GTM changes.

Measurement Framework and Prioritization

Link KPIs to stages for actionable insights: Awareness (conversion rate 5-10%, impressions >100K), Consideration (time-in-stage 70%), Retention (churn rate 40), Advocacy (referral rate 20%). Use layered swimlanes in visualizations with annotations for pain points, linked to dashboards. Prioritize touchpoints with this rubric; suggest downloadable templates via Google Sheets for journey map template and prioritization.

- Visualization best practices: Use swimlanes for personas/channels, color-code emotions (red= pain, green=delight), embed interactive links.

Prioritization Rubric

| Touchpoint | Impact (1-5) | Effort (1-5) | Scalability (1-5) | Priority Score (Impact/Effort * Scalability) |

|---|---|---|---|---|

| Email Nurture | 4 | 2 | 5 | 10 |

| Live Chat Support | 5 | 3 | 4 | 6.67 |

Measurement Framework

| Stage | Sample KPIs | Benchmark |

|---|---|---|

| Awareness | Conversion rate, Time-in-stage | 5-10%, <3 days |

| Retention | Churn rate, NPS at stage | 40 |

| Advocacy | Feature adoption, Referral rate | >70%, 20% |

Execution Checklist and Examples

Execution checklist: [ ] Define ICP/personas, [ ] Map stages/touchpoints, [ ] Collect evidence, [ ] Fuse/validate data, [ ] Assign RACI, [ ] Launch with tooling, [ ] Measure and iterate quarterly. Example: For B2B SaaS onboarding, a prioritized touchpoint backlog might focus on 'Welcome Email' (high impact, low effort) over 'Custom Dashboard' (high effort). This methodology draws from IDEO's design thinking and Nielsen Norman's UX research, ensuring scalable, evidence-based maps.

- Prioritized Backlog Example: 1. Optimize demo scheduling (impact 4/5), 2. Enhance training videos (scalability 5/5).

Success criteria: Maps drive 15% uplift in conversion; templates ready for immediate download.

Demand generation plan (channel mix, campaigns, budget, timing)

This demand generation plan provides a channel mix for SaaS companies, aligned with customer journey stages and ideal customer profiles (ICPs). It includes benchmarks, a 90-day pilot with budget allocation, attribution recommendations, and scaling strategies to drive early ARR.

To optimize demand generation, channels are selected based on journey mapping methodology and ICPs, focusing on mid-market SaaS buyers in tech sectors. For awareness, leverage content marketing and paid social to reach broad audiences; consideration involves targeted webinars and account-based marketing (ABM); conversion uses free trials and sales outreach; retention employs email nurturing and product updates. This ensures tactical alignment, maximizing ROI by tying activities to stage-specific behaviors.

Benchmarked cost-per-lead (CPL) ranges for SaaS (2024 data from HubSpot and Marketo reports): Paid social $45-120, content syndication $30-90, webinars $80-250, ABM $150-400, email $15-60. Typical CPAs range 2-5x CPL. KPIs include lead volume, conversion rates (target 5-15% stage-to-stage), and pipeline velocity. Campaign types: Awareness - educational ebooks with LinkedIn ads (creative: problem-solution infographics); Consideration - ABM personalized invites to virtual demos (creative: ICP-tailored video case studies); Conversion - trial gated content with SDR follow-up (creative: urgency-driven landing pages).

For attribution, recommend a data-driven model integrated with marketing automation (e.g., Marketo + Google Analytics) and CRM (Salesforce), feeding into journey KPIs like touchpoint contribution to ARR. This outperforms linear models by accounting for multi-channel paths, with time-decay as fallback for shorter cycles. Scale playbook: Start with pilot learnings, iterate on high-ROI channels (e.g., if ABM yields 3x CPL efficiency, allocate 40% budget), and A/B test creatives quarterly.

For mid-market SaaS, channels like ABM and webinars maximize early ARR by targeting high-value accounts, with realistic CPL targets set 20% above benchmarks initially.

Avoid over-reliance on paid channels without organic testing; benchmark against industry averages from sources like First Page Sage 2024 reports.

Channel Selection Matrix

The matrix below maps channels to journey stages and ICPs, with recommended KPIs and benchmarks.

Channel Mix for SaaS Demand Generation

| Journey Stage | Channels | ICPs Targeted | KPIs | Benchmark CPL (SaaS Mid-Market) |

|---|---|---|---|---|

| Awareness | Content syndication, Paid social (LinkedIn/FB) | Tech decision-makers, broad mid-market | Impressions, Click-through rate (CTR >2%) | Paid social: $45-120; Content: $30-90 |

| Consideration | Webinars, ABM email sequences | IT directors, procurement leads | Attendance rate (>30%), Engagement score | Webinars: $80-250; ABM: $150-400 |

| Conversion | Free trials, Sales outreach (calls/emails) | C-suite evaluators | Trial sign-ups, SQL conversion (10-20%) | Trials: $50-150; Outreach: $20-80 |

| Retention | Nurture emails, Product tips newsletters | Existing users, upsell targets | Open rate (>25%), Retention rate (85%) | Email: $15-60 |

90-Day ABM Pilot Plan

Launch a targeted ABM pilot for 50 mid-market accounts, focusing on consideration-to-conversion. Budget: $50,000 total (40% ads, 30% content, 20% tools, 10% ops). Expected outcomes: 200 MQLs, 50 SQLs, $200K pipeline. Metrics tracked via UTM and CRM integration. Creative checklist: Persona-aligned messaging, personalized assets, A/B subject lines.

90-Day Pilot Budget and Targets

| Phase (Weeks) | Activities | Budget Allocation | Targets (Leads/Pipeline) |

|---|---|---|---|

| 1-4: Setup & Awareness | Account research, LinkedIn ads, content gating | $15,000 (30%) | 100 MQLs, $50K pipeline |

| 5-8: Consideration | Webinar series, ABM personalization emails | $20,000 (40%) | 75 SQLs, $100K pipeline |

| 9-12: Conversion & Analysis | Trial demos, sales handoff, attribution review | $15,000 (30%) | 25 opportunities, $50K closed-won potential |

| Total | Full pilot execution | $50,000 | 200 total leads, $200K pipeline, 15% conversion rate |

Attribution and Measurement Integration

Use data-driven attribution to weight touchpoints by journey stage, linking to mapping KPIs like NPS per stage (>40) and time-in-stage (<30 days). Integrate with HubSpot for real-time dashboards. For scaling, if pilot CPL < $200, expand to 200 accounts; otherwise, pivot to email-heavy mix.

Creative Brief Template

- Objective: Drive [stage] actions for [ICP].

- Key Message: [Benefit tied to pain point].

- Assets: Video (30s), Email template, Landing page.

- CTA: Register now / Start trial.

- Metrics: CTR, Conversion rate.

Pricing trends and elasticity

This section analyzes pricing models for customer journey mapping methodologies, including benchmarks, elasticity insights, and strategic recommendations to optimize adoption and revenue across customer segments.

Pricing for customer journey mapping services requires balancing value delivery with market elasticity. In B2B consulting and SaaS tools, common models include project-based, subscription, outcome-based, and consumption pricing. Demand elasticity for methodology services is moderately elastic, with studies showing a -1.2 price elasticity coefficient in professional services (source: McKinsey B2B Pricing Report 2023), meaning a 10% price increase typically reduces demand by 12%. Assumptions: Elasticity derived from aggregated B2B SaaS data; actuals may vary by segment.

Benchmark price bands (sourced from Gartner CX Consulting Pricing 2024): Small customers ($1-10M revenue) - $5K-$20K per project; Mid-market ($10-100M) - $20K-$100K; Enterprise (>$100M) - $100K+ with custom negotiations. For methodology pricing model, recommend hybrid approaches: project-based for startups seeking quick wins, subscriptions for mid-market scalability.

Elasticity sensitivity: At base price of $50K for mid-market SKU, a 20% increase to $60K reduces adoption by 24% (elasticity -1.2), dropping revenue potential from $500K to $384K annually (assumption: 10 initial adopters, sourced from Deloitte Elasticity in Services 2022). Sensitivity ranges: Low elasticity (-0.8) for enterprises; high (-1.5) for startups.

Unit economics example for productized methodology SKU (subscription tier): CAC $2,500 (inbound marketing, source: HubSpot Benchmarks 2024); Payback 6 months at $10K ACV; LTV $60K over 5 years (80% retention). Model assumes 30% margin post-variable costs.

Recommended pricing strategy: Startups - Consumption pricing to minimize upfront risk, maximizing adoption (projected 40% conversion at $5K entry). Mid-market - Tiered subscriptions with bundles (e.g., basic $2K/mo, pro $5K/mo, enterprise $10K/mo; expected conversions: 25% basic, 15% pro). Enterprises - Outcome-based with success fees (10-20% of ROI). Packaging: 14-day trials, bundles with templates/tools.

Negotiation playbook for enterprise deals: Start with value-based anchoring (quantify $XM ROI from journey mapping); Offer tiered discounts (10% for 12-month commit); Include success fees tied to metrics like NPS lift (source: Bain Negotiation in B2B 2023). Sensitivity: 15% price flexibility yields 20% close rate uplift.

For SEO, recommend FAQ section: 'What is the best pricing for customer journey mapping?' covering elasticity factors and methodology pricing model variations.

- Project-based: Ideal for small segments; fixed fee reduces risk.

- Subscription: Scales for mid-market; recurring revenue stabilizes cash flow.

- Outcome-based: Aligns with enterprise value; includes success fees.

- Consumption: Flexible for startups; pay-per-use encourages trials.

- Step 1: Assess segment elasticity (startups high, enterprises low).

- Step 2: Model scenarios: +10% price → -12% adoption.

- Step 3: Adjust packaging: Bundles increase LTV by 25% (assumption sourced from SaaS Metrics Report 2024).

Comparison of Pricing Models with Recommended Approaches per Segment

| Model | Description | Recommended Segment | % Usage (2023, Gartner) | Benchmark Price Band (USD, 2024) | Elasticity Impact (Assumed -1.2 Coefficient) |

|---|---|---|---|---|---|

| Hourly | Charge per hour worked | Small (flexible needs) | 29% | $80-$500/hr | High elasticity; 10% price hike reduces hours by 12% |

| Fixed/Project | One-time fee for deliverables | Mid-market (defined scopes) | 42% | $20K-$100K | Moderate; adoption drops 12% at +10% price |

| Subscription | Recurring access to tools/templates | Mid-market & Enterprise | 18% | $2K-$10K/mo | Lower elasticity; retention buffers 8% demand drop |

| Outcome-based | Fees tied to results (e.g., ROI share) | Enterprise | 7% | $100K+ base + 15% success fee | Low elasticity (-0.8); value justifies premiums |

| Consumption | Pay-per-use (e.g., per mapping session) | Startups | 4% | $5K-$20K per unit | High elasticity; trials boost initial adoption by 30% |

| Hybrid (Recommended Overall) | Mix of subscription + project | All segments | N/A | Varies by bundle | Balances elasticity; 15% revenue uplift (Deloitte 2023) |

Price vs Adoption Sensitivity (Mid-Market Example)

| Price ($K) | Adoption Rate (%) | Projected Revenue ($K, 10 Prospects) | Assumption Source |

|---|---|---|---|

| 40 | 100 | 400 | Base case, Gartner 2024 |

| 44 (+10%) | 88 (-12%) | 387 | Elasticity -1.2, McKinsey 2023 |

| 48 (+20%) | 76 (-24%) | 365 | High sensitivity range |

| 36 (-10%) | 112 (+12%) | 403 | Low elasticity test (-0.8) |

All benchmarks are 2024 estimates; validate with current vendor pages (e.g., Salesforce CX pricing) for accuracy.

Hybrid models maximize LTV:CAC ratio at 24:1 for mid-market (assumed from HubSpot data).

Demand for methodology services is less elastic in enterprises due to strategic ROI focus.

Comparison of Pricing Models

Distribution channels and partnerships

This section explores effective distribution channels and partnership models for scaling a customer journey mapping methodology, including direct and indirect channels, platform partnerships, economics, enablement strategies, and performance KPIs to support channel strategy partner enablement and journey mapping partnerships.

Scaling a customer journey mapping methodology requires a robust channel strategy that leverages both direct and indirect distribution channels. Direct channels focus on controlled, company-led growth, while indirect channels amplify reach through partners. Platform partnerships integrate with tools like CRM and analytics vendors to enhance value. Effective journey mapping partnerships accelerate adoption by combining expertise and networks, with consulting partners and agencies often driving the fastest scale due to their client proximity and co-delivery capabilities.

Direct vs Indirect Channel Mapping and Economics

Direct channels include sales-led approaches, where dedicated teams engage prospects; product-led growth, emphasizing self-serve tools; and self-serve content like webinars and templates. These offer high control and margins (typically 70-90%) but require significant internal investment. Incentives involve commissions (10-20% of deal value) and performance bonuses.

Indirect channels encompass consulting partners, agencies, and systems integrators who resell or co-deliver services. Economics show lower margins (40-60%) due to revenue shares but faster scale via partner networks. Referral models pay 10-15% finder's fees, reseller structures 30-50% splits, and co-delivery 20-40% based on effort. Platform partnerships with Salesforce or Mixpanel involve API integrations, yielding 20-30% margins through joint go-to-market.

Channel Economics Overview

| Channel Type | Structure | Typical Margin | Revenue Split | Incentives |

|---|---|---|---|---|

| Direct (Sales-Led) | Internal Sales | 80% | N/A | Commissions 15% |

| Direct (Product-Led) | Self-Serve | 90% | N/A | Usage-Based Upsell |

| Indirect (Consulting) | Reseller/Co-Delivery | 50% | 40% to Partner | Certification Bonuses |

| Platform (CRM Integration) | Referral | 25% | 20% Referral Fee | Joint Marketing Funds |

Partner Program Structure, Tiering, and Certification

A tiered partner program fosters commitment: Bronze (referrals, basic training), Silver (resellers with sales enablement), Gold (co-sellers with certification). Certification ensures partners master journey mapping tools, requiring completion of online modules and case studies. This structure aligns with channel strategy partner enablement, offering escalating benefits like lead sharing and MDF (market development funds).

- Bronze Tier: Access to partner portal, 10% referral fee

- Silver Tier: Sales kits, 30% reseller discount, quarterly reviews

- Gold Tier: Co-marketing, 50% revenue share, dedicated support

Partner Enablement Playbook and Onboarding Checklist

Essential enablement materials include product demos, journey mapping templates, sales playbooks, and integration guides (e.g., Salesforce case studies showing 30% faster deployment). Onboarding accelerates scale, with consulting partners prioritizing due to their ability to bundle services. A co-sell playbook outlines joint pitches, emphasizing mutual value in customer journey mapping.

- Week 1: Partner qualification review and NDA signing

- Week 2: Core training on methodology and tools

- Week 3: Hands-on certification workshop

- Week 4: Access to portal and initial leads

- Ongoing: Monthly enablement webinars

Partner qualification checklist: Established CX practice (3+ years), 10+ relevant clients, compliance with data laws, commitment to 5 deals/year.

Sample contract terms are illustrative only and not legal advice; consult professionals for binding agreements.

Sample Revenue-Share and Co-Sell Models

Revenue-share model: 40% to reseller for full implementation, 20% for referrals. Co-sell example: Joint delivery where partner handles discovery (30% share) and company leads mapping (70%). These models, drawn from CX platforms like Medallia, support journey mapping partnerships with clear incentives.

Sample Revenue-Share Model

| Deal Size (USD) | Partner Share | Company Share | Notes |

|---|---|---|---|

| <50K | 50% | 50% | Referral Only |

| 50-200K | 40% | 60% | Reseller Discount |

| >200K | 30% | 70% | Co-Delivery Bonus |

KPIs to Measure Partner Performance

Track partner-sourced revenue (target 30% of total), deal velocity (average 60 days), certification completion rate (80%), and NPS from joint deals. These KPIs ensure effective channel strategy partner enablement. For a partner program landing page outline: Hero section on benefits, tier details, application form, case studies (e.g., Mixpanel integration boosting retention 25%).

- Partner-Sourced Revenue: $ amount attributed to partners

- Deal Velocity: Time from lead to close

- Certification Rate: % of partners certified

- Joint Deal Win Rate: 40% target

Regional and geographic analysis

This section provides an objective comparison of customer journey mapping adoption, pricing tolerance, regulatory considerations, and go-to-market strategies across key regions: North America, EMEA (Western Europe and Nordics), APAC (ANZ and Southeast Asia), and LATAM. It includes market opportunity estimates, buyer profiles, competitors, localization needs, and compliance guidance to inform regional expansion.

Customer journey mapping adoption varies by region, with North America leading in maturity due to high digital transformation investments. In Europe, customer journey mapping in Europe faces stringent data privacy under GDPR, influencing user research practices. APAC shows rapid growth in ANZ with SaaS-friendly ecosystems, while Southeast Asia contends with diverse regulatory frameworks like PDPA. LATAM exhibits emerging potential but regulatory hurdles via LGPD in Brazil. Pricing tolerance is highest in North America ($10K-$50K per project), moderate in EMEA ($8K-$40K), and value-sensitive in APAC and LATAM ($5K-$25K). Go-to-market nuances include direct sales in North America, partnerships in EMEA, and localized channels in APAC/LATAM. For SEO, implement hreflang tags for multilingual sites and create localized landing pages, e.g., de-de for Germany emphasizing GDPR compliance.

- Compliance Checklist for User Research: Obtain explicit consent; Anonymize data; Conduct DPIAs in EMEA/LATAM; Limit retention; Audit third-party processors; Train teams on local laws.

Regional TAM/SAM Estimates and Prioritization

| Region | TAM ($B, 2024) | SAM (% of TAM) | Adoption Rate (%) | Prioritization Rationale |

|---|---|---|---|---|

| North America | 15 | 30 | 65 | Mature ecosystem, highest ROI |

| Western Europe | 7 | 20 | 55 | GDPR drives structured approaches |

| Nordics | 3 | 25 | 60 | Innovation leaders in CX |

| ANZ | 2.5 | 25 | 58 | SaaS adoption high |

| Southeast Asia | 3.5 | 15 | 45 | Rapid digital growth |

| LATAM | 4 | 12 | 40 | Emerging but regulated |

Fastest adoption: North America (65%), followed by Nordics (60%). Regulatory constraints: GDPR/PDPA/LGPD limit user interviews to consented, anonymized data; retention capped at 2-5 years.

Avoid cultural generalizations; base strategies on reports like Gartner CX Index 2024.

North America

North America dominates with 45% global CX tech spend (Gartner 2024). TAM estimated at $15B for customer journey tools, SAM 30% for methodology services. Fastest adoption here, driven by enterprises in tech and finance. Common buyer profiles: CX directors in Fortune 500 firms. Local competitors: Forrester, Gartner. Language: English primary; minimal localization needed. Regulatory: CCPA impacts data collection, requiring opt-in consent for user interviews.

- Direct sales via webinars and conferences preferred.

- Partnerships with Salesforce/Mixpanel integrations.

- Pricing: Premium, no adjustments needed.

EMEA (Western Europe and Nordics)

EMEA accounts for 25% of global adoption, with Western Europe at 18% TAM ($10B) and Nordics at 7% SAM (20%). Customer journey mapping in Europe emphasizes privacy-first approaches. Buyers: Mid-market marketers in retail/telecom. Competitors: Local firms like Ovum in UK, Sopra Steria in France. Localization: Multilingual support (German, French); adapt messaging to cultural compliance focus. Regulatory: GDPR mandates data minimization, affecting user interviews (anonymization required) and retention (max 2 years).

- Channels: EU trade shows, LinkedIn ads.

- Partnerships: Resellers in DE/UK; certify local consultants.

- Pricing: 10-15% discount for volume; bundle with compliance audits.

APAC (ANZ and Southeast Asia)

APAC TAM $8B (20% global), SAM 15-25%; ANZ leads with mature markets (SAM 25%), Southeast Asia growing (10%). High adoption in ANZ due to tech hubs. Buyers: E-commerce leads in Singapore/Australia. Competitors: Regional players like NCS in SEA, REAN in India. Localization: English in ANZ, Bahasa/Thai in SEA; tailor messaging to mobile-first journeys. Regulatory: PDPA in Singapore limits data retention to purpose-specific periods; ANZ follows APPs with consent rules.

- Channels: Digital platforms, Alibaba partnerships in SEA.

- Partnerships: Tech alliances with Telstra in ANZ.

- Pricing: 20% lower in SEA for affordability; tiered SKUs.

LATAM

LATAM TAM $4B (10% global), SAM 10-15%, with Brazil driving growth. Emerging adoption in fintech/retail. Buyers: Regional CX managers in banks. Competitors: Local consultancies like CI&T in Brazil. Localization: Spanish/Portuguese essential; messaging highlights ROI in volatile economies. Regulatory: LGPD in Brazil requires DPIAs for user research, impacting interviews (explicit consent) and data retention (5 years max).

- Channels: Local events, WhatsApp marketing.

- Partnerships: VARs in Mexico/Brazil.

- Pricing: 25-30% adjustment; focus on outcome-based models.

Go-to-Market Recommendations and Prioritization

Recommended rollout: Start with North America (high TAM, low barriers), then UK/DE (EMEA hubs), ANZ (APAC bridge), followed by SEA/LATAM. Use hreflang for SEO (e.g., en-us, en-au) and localized pages stressing regional compliance. Localized messaging: North America - innovation focus; EMEA - trust and privacy; APAC - scalability; LATAM - cost-efficiency.

- Assess market readiness via pilots.

- Secure partnerships early.

- Monitor regulatory updates.

Regional Rollout Priority Matrix

| Region | Priority Rank | Key Opportunity | Challenges | Recommended Timeline |

|---|---|---|---|---|

| North America | 1 | High TAM (30% SAM), fast adoption | CCPA compliance | Q1 2025 |

| UK/DE (EMEA) | 2 | Mature markets, GDPR expertise | Localization costs | Q2 2025 |

| ANZ (APAC) | 3 | Tech-savvy buyers | PDPA alignment | Q3 2025 |

| Southeast Asia | 4 | Growth potential | Diverse regs | Q4 2025 |

| LATAM | 5 | Emerging TAM | LGPD hurdles | 2026 |

Strategic recommendations and implementation roadmap

This implementation roadmap for customer journey mapping provides a GTM playbook with five strategic priorities to operationalize the methodology, ensuring measurable ROI through governance, quick wins, and continuous optimization.

To successfully operationalize the customer journey mapping methodology, this section outlines an authoritative GTM playbook focused on strategic recommendations and an implementation roadmap. Drawing from best practices in GTM implementation and change management frameworks like ADKAR, the approach emphasizes cross-functional alignment, rapid pilots, and data-driven iteration. Key SEO terms include implementation roadmap customer journey mapping and GTM playbook, with internal links recommended to templates and measurement dashboards for deeper resources.

This roadmap ensures a structured path to CX transformation, with every initiative owner-defined and KPI-measurable for accountability.

Avoid delays by prioritizing quick wins in the first 30 days to secure stakeholder momentum.

Five Strategic Priorities

The following five prioritized initiatives form the core of this implementation roadmap customer journey mapping. Each includes rationale, required resources, KPIs, and a 180-day plan with milestones, owners, and decision gates. Initiatives are numbered for clarity and tied to measurable outcomes.

- Priority 1: Pilot with Prioritized Ideal Customer Profile (ICP). Rationale: Validates methodology in high-value segments to build internal buy-in and refine based on real feedback, reducing risk of broad rollout failure (per Gartner GTM best practices). Resources: 2 CX strategists (people), Miro/ Lucidchart (tech, $10K/year), $50K budget for pilot incentives. KPIs: 80% participant satisfaction score, 20% improvement in journey touchpoint efficiency. 180-Day Plan: Days 1-30: Select ICP and design pilot (owner: CX Lead; milestone: Pilot charter approved). Days 31-90: Execute workshops and map journeys (owner: Project Manager; decision gate: Mid-pilot review, approve scaling if NPS >7). Days 91-180: Analyze results and iterate (owner: Data Analyst; milestone: Final report with optimizations).

- Priority 2: Build Cross-Functional Governance. Rationale: Ensures alignment across sales, product, and marketing to embed journey mapping in GTM playbook, addressing siloed operations (ADKAR awareness stage). Resources: 1 Program Manager (people), Slack/Asana (tech, $5K/year), $30K for training. KPIs: 100% steering committee participation, 90% initiative adherence rate. 180-Day Plan: Days 1-30: Form steering committee (owner: Executive Sponsor; milestone: Charter signed). Days 31-90: Define RACI and cadence (owner: Governance Lead; decision gate: Approval of governance model). Days 91-180: Launch monthly reviews (owner: Program Manager; milestone: First quarterly audit).

- Priority 3: Instrument Analytics. Rationale: Enables real-time tracking of journey metrics to quantify impact, supporting data-driven decisions (per Forrester CX reports). Resources: 1 Data Analyst (people), Google Analytics/ Mixpanel integration (tech, $20K/year), $40K for tools. KPIs: 95% data accuracy, 15% reduction in drop-off rates. 180-Day Plan: Days 1-30: Audit current tools (owner: Tech Lead; milestone: Gap analysis complete). Days 31-90: Implement tracking (owner: Data Analyst; decision gate: Test run validation). Days 91-180: Build dashboards (owner: Analytics Team; milestone: Live reporting).

- Priority 4: Productize Templates. Rationale: Standardizes journey mapping for scalability, accelerating adoption across teams (GTM playbook efficiency). Resources: 1 Content Specialist (people), Template tools like Figma (tech, $8K/year), $25K for design. KPIs: 50 templates deployed, 70% usage rate. 180-Day Plan: Days 1-30: Inventory existing assets (owner: Content Lead; milestone: Template framework). Days 31-90: Develop and test (owner: Designer; decision gate: User feedback loop). Days 91-180: Roll out and train (owner: Training Coordinator; milestone: Adoption report).

- Priority 5: Launch Partner Program. Rationale: Extends reach through ecosystem, leveraging partners for co-created journeys (per HubSpot partner benchmarks). Resources: 1 Partnerships Manager (people), CRM integration (tech, $15K/year), $60K for incentives. KPIs: 10 partners onboarded, $100K pipeline generated. 180-Day Plan: Days 1-30: Design program tiers (owner: Partnerships Lead; milestone: Program docs). Days 31-90: Recruit and certify (owner: Manager; decision gate: First partner pilot). Days 91-180: Enable and measure (owner: Ops Team; milestone: Revenue attribution report).

Governance Model and RACI Template

A robust governance model is essential for this implementation roadmap customer journey mapping. Recommend a steering committee composed of C-level sponsors (CEO, CRO), functional leads (Sales, Product, CX), and external advisors (1-2). Cadence: Bi-weekly meetings for execution, monthly for reviews, quarterly for strategic alignment. Escalation pathways: Issues to executive sponsor within 48 hours; use ADKAR for change management (Awareness via town halls, Desire through success stories, Knowledge via training, Ability with tools, Reinforcement with KPIs).

RACI Template for Initiatives

| Activity | Responsible | Accountable | Consulted | Informed |

|---|---|---|---|---|

| Pilot Design | CX Lead | Executive Sponsor | Steering Committee | All Teams |

| Analytics Setup | Data Analyst | Tech Lead | Product Team | Sales |

| Template Rollout | Content Specialist | Governance Lead | Marketing | Partners |

| Partner Onboarding | Partnerships Manager | CRO | Legal | Operations |

180-Day Implementation Roadmap (Gantt-Like Timeline)

| Priority | Days 1-30 | Days 31-90 | Days 91-180 | Owner |

|---|---|---|---|---|

| 1: Pilot ICP | Charter Approved | Workshops Executed | Results Analyzed | CX Lead |

| 2: Governance | Committee Formed | RACI Defined | Reviews Launched | Program Manager |

| 3: Analytics | Gap Analysis | Tracking Implemented | Dashboards Live | Data Analyst |

| 4: Templates | Framework Built | Templates Tested | Training Complete | Content Specialist |

| 5: Partners | Program Designed | Partners Recruited | Program Measured | Partnerships Manager |

30-Day Quick-Win Playbook and First Hires

First three hires/roles to recruit: 1) CX Strategist for pilots, 2) Data Analyst for instrumentation, 3) Program Manager for governance. Measure pilot success by: 80% completion rate, +10 NPS lift, 25% faster journey identification. Recommend a downloadable roadmap template in Excel/Google Sheets format, linked internally.

- Conduct kickoff workshop with leadership to build awareness (ADKAR).

- Select top ICP and run mini-pilot mapping session.

- Set up basic analytics tracking for one journey stage.

- Draft initial RACI matrix and share for feedback.

- Identify quick-win template for awareness phase.

Reporting Dashboards and Continuous Optimization

Dashboards should include real-time views in Tableau or Google Data Studio, with internal links to full measurement dashboards. For continuous optimization, implement A/B testing on journey variants quarterly, with iteration cadence: Monthly reviews, bi-annual full audits. Recommend internal link to GTM playbook templates.

Mock KPI Dashboard Layout

| KPI | Target | Current | Trend |

|---|---|---|---|

| Adoption Rate | 70% | 45% | Up 15% |

| NPS Improvement | +15 | +8 | Green |

| Pipeline Generated | $100K | $60K | On Track |

| Efficiency Gain | 20% | 12% | Yellow |

Risk Mitigation Plan

- Risk: Resistance to change – Mitigate with ADKAR training sessions (owner: HR Lead).

- Risk: Resource shortages – Escalate to steering committee; buffer 20% budget.

- Risk: Data privacy issues – Conduct compliance audits pre-pilot (owner: Legal).

- Decision Gates: At 90 days, evaluate KPIs; pivot if <70% achievement.