Investment Thesis and Strategic Focus

Core Principles of Investment

Kindred Ventures is renowned for its commitment to investing in visionary founders at the earliest stages, focusing on disruptive, tech-driven companies. Their strategy is to engage from the pre-seed to Series A stages, often leading or co-leading rounds. This approach allows them to be a founder's "first call" and to provide hands-on support, acting as coaches and advisors during the critical early phases of company building. They maintain a high-conviction, concentrated portfolio, enabling them to deliver deep, hands-on support rather than spreading resources thinly across numerous ventures.

Alignment with Market Trends

Kindred Ventures' investment strategy aligns closely with current market trends, particularly in sectors like AI, blockchain, climate tech, fintech, and health & wellness. Their techno-optimist ethos reflects a belief in technology's potential to improve lives, contingent on thoughtful application by mission-driven founders. By focusing on transformative technologies and market-defining products, they position themselves at the forefront of major technological shifts. Their interest in decentralized networks and software-enabled verticals further underscores their alignment with emerging trends in blockchain and SaaS.

Evolution of Strategic Focus

Over time, Kindred Ventures has refined its strategic focus to emphasize sector-specific opportunities that align with their thesis-driven approach. Initially sector-agnostic, they have increasingly concentrated on marketplaces, decentralized networks, and frontier technologies. Their track record includes early investments in Uber, Coinbase, and Postmates, demonstrating their ability to identify and support companies that redefine their industries. This evolution underscores their commitment to backing "category-defining" companies and adapting their strategy to capture the most promising opportunities.

In summary, Kindred Ventures' investment strategy is characterized by early-stage involvement, high-conviction support, and a focus on transformative technologies. Their alignment with market trends and strategic evolution positions them as a pivotal player in the venture capital landscape.

Portfolio Composition and Sector Expertise

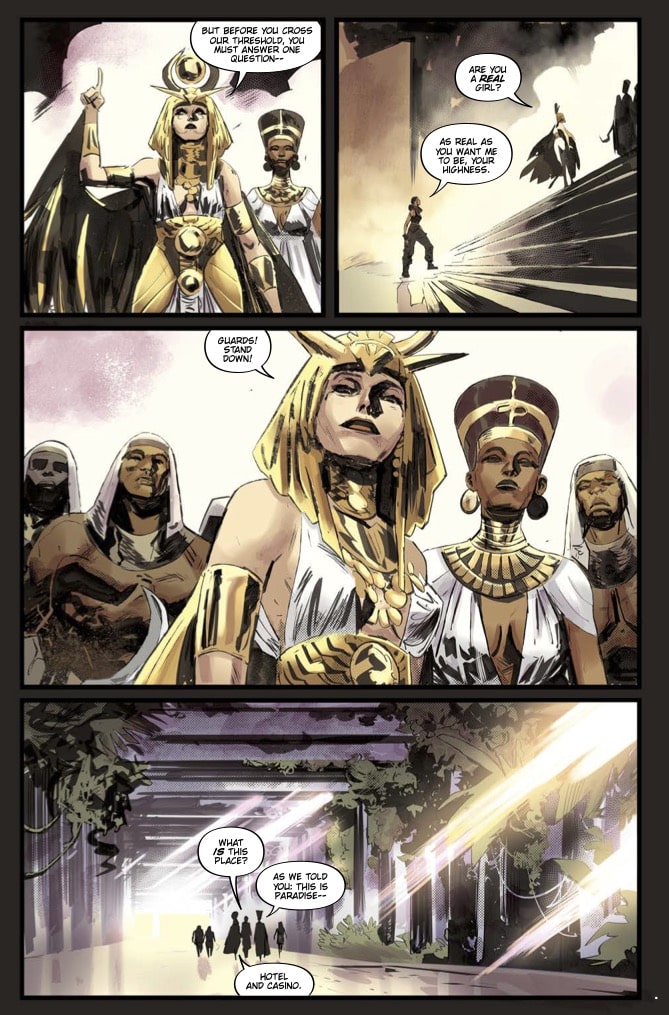

Kindred Ventures is a prominent early-stage venture capital firm with a diverse and technology-driven portfolio. Their focus spans several key industries, including artificial intelligence, climate technology, consumer products, crypto and Web3, fintech, health and wellness, mobility, and logistics. This breadth of sector expertise underscores their commitment to supporting disruptive and high-growth startups. ### Portfolio Composition Kindred Ventures has invested in over 100 companies, collectively valued at over $200 billion. Their strategic investment pattern reveals a focus on sectors where transformative technology can drive substantial impact. #### Key Industries of Focus 1. **Artificial Intelligence & Deep Tech**: Investing in startups that leverage AI for innovative solutions. 2. **Climate Technology**: Supporting sustainability-focused ventures. 3. **Consumer Products & Services**: Including marketplaces and direct-to-consumer brands. 4. **Fintech**: Active in blockchain and financial innovation. 5. **Health & Wellness**: Focus on health-oriented startups. 6. **Mobility & Logistics**: Innovations in transport and supply chain. 7. **Software (incl. SaaS)**: Investment in software platforms and SaaS. The depiction of futuristic and innovative themes in media, such as "Blade Runner: Black Lotus," resonates with Kindred Ventures' investment ethos in AI and tech-driven sectors. ### Distribution of Investments Below is a table illustrating the distribution of Kindred Ventures' investments across these sectors: ### Notable Portfolio Companies Some successful companies in their portfolio include: Through strategic investments, Kindred Ventures has established itself as a key player in nurturing startups poised to redefine industries, particularly in technology-oriented sectors.Investment Criteria

Kindred Ventures is a prominent venture capital firm known for its strategic focus on early-stage technology startups. The firm primarily operates in the **pre-seed and seed stages**, occasionally extending its reach to Series A rounds. This focus allows Kindred Ventures to engage with startups at their inception, providing crucial support and capital during pivotal growth phases. **Investment Criteria and Strategy:** 1. **Stage of Investment:** Kindred Ventures targets **pre-seed and seed-stage companies**, showing flexibility to participate in Series A rounds. This early engagement is integral to their strategy, enabling them to influence and support foundational development. 2. **Typical Check Size:** Check sizes from Kindred Ventures typically range from **$100,000 to $3 million**. This range allows them to lead or co-lead funding rounds, ensuring significant influence and involvement in the startups they back. 3. **Geographic Focus:** While Kindred Ventures has a strong concentration in the **United States**, particularly in the San Francisco Bay Area, they possess a global perspective and are open to international investments. This broad geographic focus helps them identify and support transformative technologies worldwide. Kindred Ventures’ investment portfolio features diverse sectors, including **AI, blockchain/crypto, fintech, climate tech, health, and consumer products**. This diversity reflects their commitment to backing visionary founders tackling critical global challenges. For entrepreneurs considering engagement with Kindred Ventures, it's essential to evaluate the alignment of their startup's stage, sector focus, and growth potential with the firm's criteria. Entrepreneurs should also be prepared for a hands-on partnership, benefiting from Kindred's mentorship-driven approach and strategic guidance.Track Record and Notable Exits

Kindred Ventures has established itself as a leading seed-stage venture capital firm, with a remarkable track record of successful investments and exits. Their strategy focuses on early-stage investments in technology-driven startups across various sectors, including AI, fintech, and consumer products. This approach has led to investments in over 100 companies, including 13 unicorns, 5 IPOs, and 23 acquisitions, contributing to a portfolio market capitalization exceeding $200 billion as of April 2025. Notable exits from Kindred Ventures include early investments in companies like Coinbase, which went public in April 2021, marking a significant outcome in the fintech sector. Other successful exits include Blue Bottle Coffee, acquired by Nestlé in 2017, and RangeMe, acquired by ECRM in 2021. These exits highlight Kindred Ventures' ability to identify and nurture high-potential startups. The impact on Kindred Ventures' reputation has been substantial, solidifying their status as a top-tier venture capital firm. Their proactive involvement in forming and supporting startups has contributed to their success. In conclusion, Kindred Ventures' track record speaks volumes about their ability to drive growth and achieve successful exits, enhancing their reputation in the venture capital community.Team Composition and Decision-Making

Key Team Members

Kindred Ventures, a seed-stage venture capital firm based in San Francisco, is spearheaded by Steve Jang (Founder & Managing Partner) and Kanyi Maqubela (Partner/Managing Partner). The firm operates with a lean team of about five members, underscoring a partner-driven model that emphasizes direct engagement with founders.

Expertise and Backgrounds

Both Jang and Maqubela bring extensive experience as founders, early employees, and advisors in technology startups. Their collective portfolio includes investments in over 100 companies, featuring industry giants like Uber, Coinbase, and Postmates. This deep-rooted experience in tech startups enriches their investment strategy, allowing them to provide high-touch founder support and strategic guidance at the earliest stages of company formation.

Decision-Making Framework

Kindred Ventures adopts a high-touch, founder-focused decision-making process, particularly at the pre-seed and seed stages. The firm places a significant emphasis on the founding team's vision and adaptability rather than solely focusing on the product. Their framework includes:

- Initial Assessment: Evaluating the founding team's capabilities and vision through multiple in-depth discussions.

- Multiple Conversations: Engaging in several dialogues with founders to understand their thinking styles and visions deeply.

- Active Collaboration: Partnering with entrepreneurs before company formation, aiding in team assembly and initial strategy shaping.

This approach allows Kindred Ventures to support and mentor founders, helping to refine their ideas and strategies effectively.

Value-Add Capabilities and Support

Kindred Ventures distinguishes itself as a seed-stage venture capital firm with a unique value-add approach, emphasizing hands-on engagement and active company formation. This goes beyond traditional investment, as Kindred not only invests in existing startups but also helps to form companies from the concept stage. By assembling founding teams around impactful problems, Kindred acts as a true operating partner.

Resources and Mentorship

Kindred Ventures maintains a concentrated portfolio model, targeting approximately 25 companies per fund cycle. This allows for outsized attention and meaningful mentorship. The firm's partners, including Steve Jang and Kanyi Maqubela, provide adaptive coaching and problem-solving, positioning themselves as the first call for founders facing strategic challenges or needing morale support.

Strategic Guidance

With a sector-agnostic but thematically focused approach, Kindred Ventures supports diverse founders in areas such as marketplaces, SaaS, decentralized networks, and frontier technologies. The firm is committed to leading seed rounds and actively assists in orchestrating follow-on fundraises, ensuring continuity of support beyond initial investments.

Impact on Portfolio Companies

Portfolio companies have attested to the significant impact of Kindred's involvement. One founder noted, "Kindred's strategic guidance and hands-on approach were pivotal in shaping our company's early direction and securing further investment." However, with its small portfolio model, some founders suggest expanding its resources to address growing demands.

Overall, while Kindred Ventures excels in offering concentrated mentorship and strategic guidance, there is room for growth in scaling its support resources as its portfolio evolves.

Application Process and Timeline

Startups seeking investment from Kindred Ventures should be prepared to navigate a detailed application process. This guide outlines the necessary steps, key milestones, and offers tips for a successful application.

Application Steps

- Initial Contact: Start by networking with key stakeholders or via introductions, which can take several weeks to months.

- Proposal Submission: Email a comprehensive pitch deck to the relevant contact at Kindred Ventures. Include your business model, market potential, team background, and financial projections.

- Review and Feedback: Kindred Ventures will review submissions on a rolling basis. If interested, they might request further documentation or a follow-up meeting.

- Due Diligence: This phase involves in-depth analysis and can last several weeks. Be prepared to provide detailed business information.

- Negotiation and Closing: If successful, negotiations on terms and conditions will ensue, leading to a final agreement.

Key Milestones

- Initial Introduction: Establish contact and build rapport with Kindred Ventures.

- Pitch Submission: Submit your pitch deck with detailed business insights.

- Feedback Meeting: Participate in discussions and provide additional information as needed.

- Due Diligence Completion: Successfully navigate the due diligence process.

- Investment Agreement: Finalize terms and secure investment.

Tips for Success

- Research: Understand Kindred Ventures' investment focus and tailor your pitch accordingly.

- Networking: Leverage connections within the startup ecosystem for introductions.

- Preparation: Ensure your financials and business plan are robust and well-documented.

- Clarity: Clearly articulate your value proposition and growth potential.

- Follow-up: Maintain communication throughout the process to demonstrate interest and engagement.

By following these steps and tips, startups can effectively engage with Kindred Ventures and enhance their chances of securing investment.