Introduction to NFX

A comprehensive introduction to NFX, a venture capital firm known for its focus on network effects and early-stage investments.

NFX is a venture capital firm founded in 2015 by James Currier, Pete Flint, Gigi Levy-Weiss, and Stan Chudnovsky. The firm specializes in early-stage investments, with a particular focus on companies where network effects are central to market transformation. NFX operates with a unique model, offering founders operational support, access to a large network, and proprietary frameworks for startup growth.

Since its inception, NFX has invested in over 577 companies globally, mostly in the pre-seed and seed stages, and has managed over $875 million in total assets as of 2025. The firm is recognized for early backing of notable startups including Lyft, DoorDash, Patreon, Houseparty, Playtika, and Wolt. NFX's community-driven approach offers founders access to a large peer network for sharing key metrics, insights, and strategic guidance.

NFX's founding marked the creation of one of the leading early-stage venture capital firms, with a distinctive focus on network effects, deep operational support, and a strong presence in both the US and Israel. The firm's foundational philosophy is that network effects are the primary drivers of value creation in technology startups, accounting for an estimated 70% of tech sector value.

NFX Founding Year and Key Milestones

| Year | Milestone |

|---|---|

| 2015 | NFX founded by James Currier, Pete Flint, Gigi Levy-Weiss, and Stan Chudnovsky |

| 2017 | Launch of Fund I with $150 million |

| 2019 | Launch of Fund II with $275 million |

| 2021 | Launch of Fund III with $450 million |

| 2025 | Launch of Fund IV with $325 million |

Investment Thesis and Strategic Focus

An analysis of NFX's investment thesis and strategic focus, detailing their prioritized sectors, technologies, and differentiation from competitors.

NFX's investment thesis is centered on harnessing the power of network effects, particularly in sectors such as Bio, Gaming, Generative AI, PropTech, Space, Marketplaces, FinTech, and Crypto. They focus on pre-seed and seed-stage investments, aiming to back exceptional founders who can leverage these effects for outsized growth.

The image below illustrates the rise of AI, a key area of interest for NFX, aligning with their focus on sectors with strong network effects.

NFX differentiates itself from other venture capital firms through its emphasis on network effects, early-stage investments, and comprehensive founder support. Their strategic focus on emerging sectors positions them uniquely in the market.

Differentiation from Competitors

| Aspect | NFX Approach | Competitors |

|---|---|---|

| Investment Stage | Pre-seed and Seed | Varied, often later stages |

| Sector Focus | Bio, Gaming, Generative AI, etc. | Varied, often broader |

| Network Effects | Core focus | Secondary or less emphasized |

| Founder Support | Comprehensive, including NFX Guild | Varied, often less structured |

| Check Size | $1M to $5M | Varied, often larger |

| Lead Investments | Preference to lead | Often participate or follow |

| Partner Background | Former founders | Varied, often financial backgrounds |

Portfolio Composition and Sector Expertise

An in-depth analysis of NFX's portfolio composition, highlighting sector diversity and strategic alignment.

NFX's portfolio reflects a well-rounded approach with investments spanning multiple sectors and stages. Their expertise in specific industries such as marketplaces, SaaS, and fintech provides a strategic advantage to their portfolio companies.

The strategic investments by NFX across these sectors showcase their ability to identify and nurture high-potential companies, driving them towards successful exits and market leadership.

Portfolio Diversity and Breakdown

| Sector | # Portfolio Companies |

|---|---|

| SaaS | 82 |

| Marketplaces | 75 |

| Fintech | 32 |

| AI | 35 |

| Crypto | 31 |

| Gaming | 29 |

| Consumer | 32 |

| Bio | 19 |

| PropTech | 16 |

| Insurance | 6 |

| Legal Tech | 4 |

| Space | 3 |

Sector Expertise and Value-Add

NFX leverages its deep sector knowledge to create value for its portfolio companies. By focusing on industries where they have strategic expertise, NFX helps companies like Doordash and Lyft to scale efficiently and achieve market success. Their involvement in fintech through companies like HoneyBook and Anchorage Digital demonstrates their ability to navigate complex financial landscapes.

Examples of Strategic Alignment

NFX's strategic alignment with portfolio companies is evident in their investment in Doordash, which became a marketplace leader, and Global-e, which successfully went public. This alignment ensures that companies not only receive financial backing but also benefit from NFX's industry insights and networks.

Investment Criteria

NFX's investment criteria focus on pre-seed and seed-stage startups building scalable platforms with network effects, primarily investing in Israel and the US.

NFX has carved out a niche by focusing on pre-seed and seed-stage startups that are building products with inherent network effects. These investment criteria align with their strategic focus on sectors where network dynamics can provide a lasting competitive advantage.

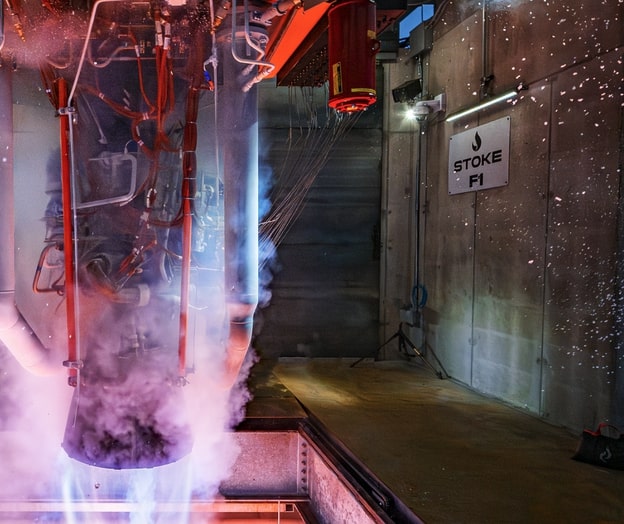

Recently, Stoke Space raised $510 million to develop the Nova Reusable Rocket, exemplifying the kind of scalable and groundbreaking projects that align with NFX's interest in network effects and high-potential tech verticals.

NFX's criteria, when compared to industry norms, emphasizes an early-stage, high-engagement approach, which is attractive for entrepreneurs seeking both capital and hands-on support.

- Preferred Stages: Pre-seed and seed stages

- Typical Check Sizes: $1 million to $5 million

- Geographic Preferences: 40% in Israel, 60% in the US and other global hubs

NFX Investment Criteria Overview

| Criteria | Details |

|---|---|

| Stage | Pre-seed and seed |

| Sector Focus | AI, developer tools, cybersecurity, fintech, crypto, consumer apps, biotech, marketplaces, gaming, proptech, space, Web3 |

| Network Effects | Preference for products benefiting from network effects |

| Founder Quality | Exceptional founders with relevant experience |

| Scalability | Platforms or products that can scale rapidly |

| Ownership | 10-15% at seed, reserves for follow-ons |

| Traction | Early product signals at seed stage |

NFX's current fund (Fund IV, $325M closed in October 2025) targets roughly 50 new startups, maintaining their early-stage, high-engagement approach.

Strategic Focus and Investment Thesis

NFX's strategic focus is deeply intertwined with their investment thesis, which prioritizes startups with strong network effects. This focus is evident in their sector preferences, which include high-growth areas like AI and Web3.

Comparison to Industry Norms

Compared to industry norms, NFX's criteria are distinctive for their emphasis on early-stage investments and significant hands-on support, setting them apart as a venture capital firm dedicated to nurturing innovative ideas from inception.

Track Record and Notable Exits

An analysis of NFX's successful track record, focusing on notable exits and their impact.

NFX has established itself as a formidable player in the venture capital landscape, particularly noted for its successful exits which have significantly enhanced its reputation. The firm's focus on network-effect driven companies has resulted in several high-profile exits, reflecting its strategic acumen. Notable exits include Playtika's IPO, Wolt's acquisition by DoorDash, and significant exits in fintech and enterprise software sectors. These successes not only demonstrate NFX's ability to identify and nurture high-potential startups but also reinforce its standing as a leading venture capital firm.

The IPO of Playtika represents one of the largest Israeli tech IPOs in the U.S., showcasing NFX's foresight in investing in promising companies early. Similarly, Wolt's acquisition by DoorDash highlights NFX's strategic focus on companies leveraging network effects, further validating its investment thesis. These exits have not only provided substantial returns but have also positioned NFX as a preferred partner for startups seeking growth and successful exits.

NFX's track record of approximately 29-30 portfolio exits underscores its ability to deliver strong early-stage venture returns. The firm's continued success in exiting companies like Similarweb and CircleUp, along with recent exits in enterprise software and proptech, suggests a robust investment strategy poised for future growth. These achievements have earned NFX industry recognition and awards, further solidifying its reputation as a leading venture capital firm.

Key Metrics and Performance Data

| Metric | Value |

|---|---|

| Total Exits | 29-30 |

| Notable IPO | Playtika |

| Notable Acquisition | Wolt by DoorDash |

| Sector Focus | Network-driven sectors |

| Investment Regions | Israel, U.S. |

Case Studies of Successful Exits

| Company | Exit Type | Sector | Outcome |

|---|---|---|---|

| Playtika | IPO | Gaming | Largest Israeli tech IPO in U.S. |

| Wolt | Acquisition | Food Delivery | Acquired by DoorDash |

| Similarweb | IPO | Data/Analytics | Publicly traded |

| CircleUp | Acquisition | Fintech | Acquired |

| Veriti | Exit | Enterprise Software | Successful exit in 2025 |

Key Metrics and Performance Data

NFX's performance is highlighted by its strong track record of exits, particularly in sectors driven by network effects. The firm's strategic investments in companies like Playtika and Wolt have resulted in significant returns and industry accolades.

Impact on Reputation and Strategy

The successful exits of companies in NFX's portfolio have bolstered its reputation as a leading venture capital firm. These exits not only provide financial returns but also validate NFX's investment strategies, attracting more startups and investors.

Case Studies of Successful Exits

NFX's portfolio includes several high-profile exits that underscore the firm's strategic prowess. Companies like Playtika and Wolt have set benchmarks in their respective sectors, demonstrating the value NFX adds to its investments.

Team Composition and Decision-Making

An analysis of NFX's team composition, highlighting key partners and decision-makers, the decision-making process, and alignment with NFX's strategic focus.

NFX has built a robust team composed of experienced General Partners, senior investment professionals, and a wide-ranging support network. This enables them to operate effectively as both a traditional venture capital firm and a platform offering operational support to portfolio companies. The core leadership team, including General Partners like Morgan Beller and James Currier, brings in-depth expertise across various sectors, enhancing NFX's investment capabilities.

- Morgan Beller

- Omri Drory, Ph.D.

- Pete Flint

- Gigi Levy-Weiss

- James Currier

Summary Table

| Role/Team | Key Members / Size |

|---|---|

| General Partners | Morgan Beller, Omri Drory, Pete Flint, Gigi Levy-Weiss, James Currier |

| Venture Partner | Stan Chudnovsky |

| Partners | Anna Piñol, Sarai Bronfeld |

| Principals | Daniel Museles, Valerie Osband Mahoney |

| Bio Investment Committee | Emily Leproust |

| Operations/Admin | Chris Travers (COO), Matt Foxworthy (CFO), Davis Doherty (General Counsel) |

| Platform Team | 45 members |

| Total Staff | 109 employees |

| NFX Fellows (2025) | 19 graduate/postgrad students from top US universities |

Expertise and Backgrounds

The NFX team is led by General Partners with extensive backgrounds in venture capital, entrepreneurship, and technology. James Currier, a founding partner, is known for his expertise in network effects. Other partners like Morgan Beller and Pete Flint bring significant experience from their tenure at successful tech companies and startups.

Decision-Making Process

Investment decisions at NFX are made through a collaborative process involving the General Partners and key decision-makers. The Bio Investment Committee, led by Emily Leproust, for instance, focuses on decisions related to biotechnology investments. This collective approach ensures diverse perspectives and expertise are applied, enhancing the decision-making process.

Alignment with Strategic Focus

NFX's team composition is strategically aligned with its focus on network effects and technology-driven investments. The diversity in expertise, from venture capital to operations and protocol design, supports NFX's investment thesis and enhances its ability to identify and nurture high-potential startups.

Value-Add Capabilities and Support

Explore the value-add capabilities and support that NFX offers to its portfolio companies, highlighting specific programs, resources, and networks that enhance growth and success.

Network Effects Expertise

NFX stands out for its deep understanding of network effects, providing founders with extensive resources like the 'Network Effects Bible' and 'Network Effects Manual'. These resources are designed to help businesses optimize their network effects, a critical component for scaling and defensibility.

- 16 Types of Network Effects: NFX categorizes and explains 16 distinct types of network effects.

- Defensibility Strategy: Guidance on reinforcing defensibility through network effects, scale, brand, and embedding.

Data-Driven Insights & Benchmarking

NFX provides proprietary data and benchmarking tools that allow founders to compare their performance against industry standards. This data-driven approach helps in optimizing growth strategies and product-market fit.

- Benchmarking Tools: Access to proprietary data on growth, retention, and network effects.

- Growth Analytics: Analysis of user behavior, retention, and virality.

Operational Support & Talent Network

NFX offers robust operational support, connecting founders with top-tier talent and sharing practical playbooks on various business strategies. Their founder community fosters collaboration and peer learning.

- Talent Introduction: Connections to top-tier talent, advisors, and potential hires.

- Operational Playbooks: Guidance on fundraising, hiring, scaling, and go-to-market strategies.

Strategic Guidance & Reinforcement

NFX emphasizes a long-term vision for value creation, teaching founders how to build a 'reinforcement' effect by layering multiple defensibilities. This approach ensures sustainable growth and resilience.

- Reinforcement Framework: Layering of network effects, scale, and brand for resilience.

- Go-to-Market Playbooks: Building virality and network effects into product design.

Content & Thought Leadership

NFX is committed to producing high-quality, evergreen content that serves as a valuable resource for founders. Their masterclasses and events further enhance knowledge sharing and skill development.

- Evergreen Content: Articles, podcasts, and videos on network effects and startup growth.

- Masterclasses & Events: Workshops and events featuring industry experts.

Application Process and Timeline

Explore the streamlined application process and evaluation criteria of NFX for entrepreneurs seeking investment.

Application Process Steps

NFX has designed a swift and efficient application process tailored for pre-seed and seed-stage startups. Founders interested in securing investment must follow a structured approach to submit their applications.

- Submit a pitch deck and a one-minute video presentation with the founders and team.

- Answer 12 specific questions about the company and business model.

- Applications are submitted through BriefLink, a private submission link provided by NFX.

Typical Timeline for Decisions

NFX's FAST funding track is known for its rapid decision-making process, allowing startups to receive funding decisions swiftly.

- Initial feedback within 3 business days of submission.

- Funding decisions are made within 9-14 days from the initial contact.

- If successful, the funds can be transferred to the startup's account within 3 weeks.

Evaluation Criteria and Tips

NFX evaluates potential investments based on several factors, focusing on businesses driven by network effects. Entrepreneurs can enhance their application by keeping certain aspects in mind.

- Focus on sectors such as software, marketplaces, generative AI, labor marketplaces, and proptech.

- Ensure the core market is in the US or Israel, or demonstrate significant audience presence in these regions.

- Utilize AI tools like Heygen for compelling video presentations.

NFX does not invest in pure hardware, pharmaceuticals, semiconductors, or medical devices.

All applicants receive feedback, irrespective of the funding decision.

Portfolio Company Testimonials

Testimonials from NFX portfolio companies highlight the firm's hands-on approach, technology-driven value-add, and impactful strategic guidance. Founders appreciate the network introductions and data-driven storytelling advice provided by NFX, though some suggest further transparency in communications.

Examples of NFX Contributions

NFX has been instrumental in facilitating introductions to top-tier VCs for its portfolio companies. Incredible Health's CEO, Iman Abuzeid, credits NFX for strategic guidance during fundraising, particularly in enhancing pitch decks with data-driven storytelling. This approach reinforced investor confidence, leading to successful funding rounds.

Recurring Themes in Feedback

A common theme among testimonials is NFX's emphasis on leveraging network effects and marketplace expertise. Founders frequently mention the value of NFX’s proprietary tools, such as Signal and BriefLink, which aid in investor discovery and pitch deck analytics.

Balanced View of Strengths and Weaknesses

While NFX is praised for its innovative tools and strategic support, some founders suggest that the firm could improve by offering more transparent communication during critical decision-making processes. Overall, NFX's strengths lie in its network-building capabilities and its focus on data-driven strategies.

Market Positioning and Differentiation

An analysis of NFX's market positioning and differentiation within the venture capital industry, highlighting their unique strategies and methodologies.

NFX has established itself as a leader in the venture capital industry by focusing on early-stage investments in marketplace startups and businesses that benefit from network effects. This strategic focus allows NFX to identify and nurture companies that can achieve defensible market leadership by increasing product value as more users join. Their approach is characterized by a combination of deep operational expertise and research-driven frameworks.

NFX distinguishes itself from other venture capital firms through several unique methodologies. The development of their Marketplace Scorecard, which includes 28 elements, provides a systematic evaluation of marketplace startups. This tool helps both founders and investors assess competitive strengths and potential market challenges, offering a rigorous framework for investment decisions.

The firm's contrarian growth strategies encourage startups to explore unconventional market entry and expansion tactics. By targeting less competitive markets initially, as seen with DoorDash's approach, NFX-backed companies can secure local leadership before expanding further. This strategy is supplemented by their 'killer wedge' concept, which emphasizes starting with underserved niches to achieve rapid adoption and product-market fit.

NFX's success and reputation are further bolstered by their product-led growth approach. This strategy enables startups to leverage technology for rapid network growth, independent of traditional sales models. Additionally, NFX's domain breadth across sectors like fintech, healthtech, and e-commerce infrastructure allows them to apply repeatable frameworks for rapid user adoption and defensibility.

Overall, NFX's market positioning is defined by their thought leadership in networked marketplaces, distinctive frameworks for evaluating and scaling startups, and a strong track record of identifying and developing successful ventures.

Market Share and Competitive Advantages

| Aspect | Details |

|---|---|

| Network Effects Focus | Expertise in scaling businesses with network effects. |

| Marketplace Scorecard | 28 elements to evaluate marketplace startups. |

| Contrarian Growth Strategies | Encourages unconventional market entry tactics. |

| Wedge-Based Market Entry | Focus on underserved niches for rapid adoption. |

| Product-Led Growth | Leveraging technology for network growth. |

| Domain Breadth | Investments across fintech, healthtech, and more. |

NFX's unique methodologies and strategic focus on network effects and marketplaces distinguish them in the venture capital industry.

Contact and Next Steps

Essential contact information and guidance for entrepreneurs interested in engaging with NFX.

Contact Information

| Purpose | Contact Information |

|---|---|

| Mailing address | 32 Page Street, SF, CA 94102 |

| General email | qed@nfx.com |

| Phone | (408) 748-9200 |

| Website | www.nfx.com |

| SF office address | 34 Page St, SF, CA 94102 |

| Alt. SF addresses | 156 2nd St / 604 Mission St |

| Palo Alto office | 400 Florence St, Palo Alto, CA |

| Israel office | 50 Ramat Yam St, Herzliya, Israel |

For most inquiries, using the general email (qed@nfx.com) or the website's contact form is recommended.

For investment-related matters, a warm introduction is preferred.

Contact Details and Channels

NFX provides several ways for entrepreneurs to get in touch. The primary method is through email at qed@nfx.com. For general inquiries, you can also use daniel@nfx.com. For more direct communication, consider reaching out via their phone number or visiting their offices in San Francisco, Palo Alto, or Israel.

Points of Contact within NFX

While there are no specific names provided for direct contact, using the general email or visiting the NFX website will connect you with the right team members. For investment inquiries, leveraging a warm introduction or using NFX's Signal platform is recommended.

Guidance on Next Steps

Entrepreneurs interested in exploring investment opportunities with NFX should prepare a concise and compelling pitch. Utilizing the Brief Link platform can help streamline the presentation of your investment case. Establishing connections through a warm introduction or the Signal platform will enhance your chances of a successful engagement.