Investment Thesis and Strategic Focus

Zetta Venture Partners focuses on early-stage AI-native B2B startups, emphasizing sectors like AI applications, developer tools, and data infrastructure. Their investment strategy is built on deep technical expertise and a hands-on approach, adapting to market trends and evolving needs of AI-driven businesses.

Core Principles of Investment Thesis

Zetta Venture Partners' investment thesis is centered around the belief that AI-native, business-to-business (B2B) startups represent the future of market leadership. Their core principles include focusing on companies that leverage artificial intelligence and machine learning as fundamental technologies. By investing in these startups, Zetta aims to support the transformation of machine learning models into market-leading products.

Sector Focus and Rationale

Zetta prioritizes investments in sectors where AI can deliver significant value, such as biotechnology, climate technology, DevOps/cloud infrastructure, and cybersecurity. The rationale behind this focus is the potential for AI to solve complex enterprise problems and drive innovation in these areas. By investing in AI applications, developer tools, and data infrastructure, Zetta seeks to back startups that can redefine industries through technological advancements.

Evolution of Investment Strategy

Over time, Zetta's investment strategy has evolved to adapt to market changes and the growing needs of AI-driven businesses. Initially the first venture capital firm to focus exclusively on AI-native B2B companies, Zetta has expanded its capacity to lead larger funding rounds and provide long-term support through funds like Zetta Venture Partners III. This evolution reflects their commitment to being a hands-on partner with deep technical and operational expertise, addressing challenges such as data cold-start problems and regulatory navigation.

Portfolio Composition and Sector Expertise

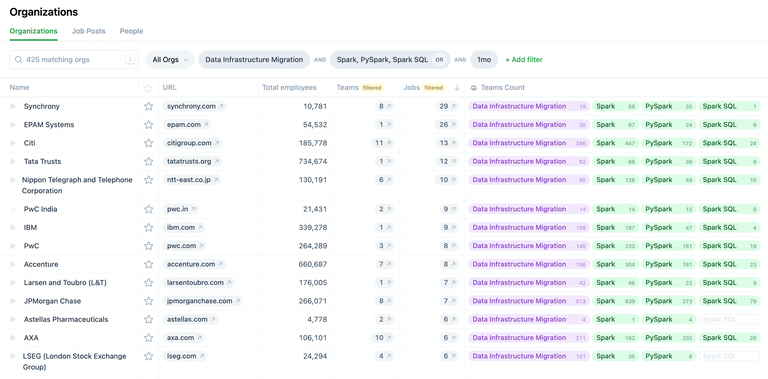

An analysis of Zetta Venture Partners' portfolio reveals significant investments in AI-driven B2B startups, with notable expertise in sectors like AI applications and infrastructure.

Zetta Venture Partners has established a strong foothold in the realm of AI-driven B2B startups, focusing on intelligent enterprise software across North America and Europe. Their strategic investment approach is evident in the composition of their portfolio, which spans several key sectors.

The inclusion of companies like Sumble exemplifies Zetta's commitment to expanding AI capabilities in various industries.

Breakdown of Portfolio by Sector and Notable Companies

| Sector | Number of Companies | Notable Companies |

|---|---|---|

| AI & Deep Tech | 20 | Lilt, Opsani |

| Data & Analytics | 25 | Clearbit, TelmAI |

| Software & Apps | 15 | Domino Data Lab |

| Healthtech | 10 | Faro Health |

| AI Infrastructure | 12 | Weaviate |

| Security & Privacy | 8 | Trustero |

Key Metrics of Sector Expertise and Success Stories

| Metric | Value | Description |

|---|---|---|

| Total Investments | 99-112 | Range due to varying sources |

| Portfolio Exits | 14 | Successful exits as of late 2024 |

| Average Check Size | $1.2M | Typical investment size |

| Recent Acquisition | Argilla | Acquired June 13, 2024 |

| Recent Investment | Axiom Bio | $15M Seed (April 28, 2025) |

Sector Expertise and Its Benefits

Zetta's expertise in AI applications and infrastructure not only guides their investment choices but also provides substantial value to their portfolio companies. By focusing on sectors like data analytics, AI, and healthtech, Zetta ensures that their investments align with technological trends and industry needs.

Notable Companies and Success Stories

Zetta's portfolio features companies that are pioneering advancements in their respective fields. Clearbit and Lilt are prime examples of how strategic investments can lead to significant breakthroughs in data enrichment and AI translation technologies.

Investment Criteria

An overview of the investment criteria used by Zetta Venture Partners, focusing on early-stage AI-native startups.

Zetta Venture Partners focuses on early-stage investments in AI-native startups, specifically those building applications, developer tools, and data infrastructure. Their investment strategy centers around being the first significant institutional investor in a company at the pre-seed or seed stage, often at the 'founder + idea' phase.

Zetta exclusively invests in artificial intelligence and intelligent enterprise software—applications that leverage AI, as well as developer tools and data infrastructure enabling AI productization. They target pre-seed and seed rounds, with the intention to often lead or co-lead funding rounds.

The typical initial investment ranges from $1M to $5M, with reserves for follow-on funding in later rounds. Geographically, Zetta primarily invests in startups based in North America and Europe.

Zetta looks for AI-native startups with technical founding teams building differentiated technology. They prefer startups that are less than 4-5 years old and generally not large founding teams (fewer than five founders is ideal).

Zetta positions itself as a partner for founders seeking long-term, thematic capital and deep expertise in scaling AI-native software businesses. They support their portfolio companies with active, strategic guidance in areas such as recruiting, product and data strategy, go-to-market, introductions to design partners, and fundraising.

Preferred Investment Stages and Typical Check Sizes

| Investment Stage | Typical Check Size |

|---|---|

| Pre-seed | $1M - $5M |

| Seed | $1M - $5M |

| Sweet Spot | $2.5M |

Track Record and Notable Exits

Zetta Venture Partners has established a strong track record as an early-stage investor in AI-native startups, primarily focused on B2B business models. With 112 investments and 14 notable exits, they have made significant contributions to their portfolio companies' growth and success, enhancing their reputation and strategic positioning in the venture capital landscape.

Zetta Venture Partners has consistently demonstrated its expertise in identifying and nurturing AI-native startups. Their focus on business-to-business models has allowed them to create a niche in the venture capital market, particularly within the United States. As of late 2025, they have invested in 112 companies and achieved 14 successful exits.

The firm's notable exits include companies like Argilla, Tabular, and Breeze Intelligence, which were acquired in 2024 and 2023, respectively. These exits have not only provided financial returns but have also cemented Zetta's reputation as a leading investor in AI and data infrastructure.

Zetta's strategy involves leading seed rounds and supporting technical founders with industry connections and board guidance. Their approach has resulted in strong endorsements from portfolio companies like Domino Data Lab and Weaviate, among others.

While specific exit valuations are not publicly available, the pattern of successful investments and exits highlights Zetta's ability to identify high-potential startups and support them through critical growth stages.

Chronological Events of Successful Investments and Notable Exits

| Event | Company | Date |

|---|---|---|

| Investment | Axiom Bio | April 2025 |

| Investment | VideaHealth | January 2025 |

| Investment | Trustero | November 2024 |

| Exit | Argilla | June 2024 |

| Exit | Tabular | June 2024 |

| Exit | Breeze Intelligence | November 2023 |

| Exit | Featureform | 2023 |

| Exit | Clearbit | 2022 |

Performance Metrics and KPIs of Notable Exits

| Company | Type of Exit | Impact |

|---|---|---|

| Argilla | Acquisition | Strengthened market presence |

| Tabular | Acquisition | Expanded strategic partnerships |

| Breeze Intelligence | Acquisition | Enhanced reputation in AI |

| Featureform | Acquisition | Increased investor confidence |

| Clearbit | Acquisition | Broadened industry influence |

Team Composition and Decision-Making

An overview of Zetta Venture Partners' team composition, key members, investment strategy, and decision-making process.

Key Team Members and Expertise

Zetta Venture Partners boasts a team of seasoned investors and operators with diverse backgrounds. Mark Gorenberg, the Founder and Managing Director, has over 30 years of venture capital experience and a history as a software executive. Jocelyn Goldfein, a Managing Director, is renowned for her expertise in AI and ML, providing hands-on support to portfolio companies. Apoorva Pandhi, another Managing Director, brings a wealth of knowledge in machine learning and data platforms. Dylan Reid and Annelies Gamble contribute to the firm's operational and investment strategies.

- Mark Gorenberg: Founder and Managing Director with a background in software and entrepreneurship.

- Jocelyn Goldfein: Managing Director known for AI and ML expertise.

- Apoorva Pandhi: Managing Director with a focus on machine learning and data platforms.

- Dylan Reid: New York City-based team member involved in early-stage investments.

- Annelies Gamble: San Francisco-based team member providing operational support.

Investment Decision-Making Process

Zetta Venture Partners' investment strategy is led by a small team of managing directors who leverage their operational backgrounds and deep expertise in AI to evaluate early-stage, B2B AI startups. The firm seeks to be the first investor, typically placing $1–3 million checks at the seed stage. This approach reflects their founder-centric philosophy, aiming to build AI-first businesses from the ground up.

Team Dynamics and Culture

The team at Zetta Venture Partners is characterized by a collaborative and hands-on culture. Leadership members actively serve on company boards and provide strategic guidance to portfolio founders. The firm's exclusive focus on early-stage, AI-first, B2B startups sets it apart from other venture capital firms, fostering a unique environment where innovation and support are prioritized.

Value-Add Capabilities and Support

Zetta Venture Partners offers specialized support to AI-focused B2B startups, enhancing their growth and success through technical expertise, operational guidance, and strategic connections.

Resources and Networks Provided

Zetta Venture Partners provides a rich array of resources and networks to its portfolio companies. With partners who have experience as entrepreneurs and engineers, Zetta offers deep technical leadership and expertise crucial for AI companies. Their sector-specific knowledge helps startups address challenges such as building machine learning systems, data acquisition, and scaling predictive technologies. Additionally, Zetta facilitates access to proprietary talent networks and industry experts, enabling companies to attract top-tier talent.

Impact of Support on Portfolio Companies

The impact of Zetta's support is evident in the success stories of its portfolio companies. Notable examples include Kaggle, which was acquired by Google, and Tractable. Founders consistently highlight Zetta's unique expertise in navigating AI market challenges and its hands-on operational support. This backing has been pivotal in helping companies refine their go-to-market strategies, grow customer bases, and make significant business decisions, including fundraising and exits.

Alignment with Investment Thesis

Zetta's value-add services align seamlessly with their investment thesis, which focuses on AI-native, B2B companies. By exclusively investing in this niche, Zetta ensures its resources and expertise are tailored to the unique demands of AI-driven businesses. Their commitment as early-stage investors, usually leading seed rounds, underscores their founder-first philosophy. This approach not only supports the immediate needs of startups but also enhances the overall performance of their portfolio.

Application Process and Timeline

Outline the application process for startups seeking investment from Zetta Venture Partners. Describe the steps involved, from initial contact to final decision. Include typical timelines and any key milestones. Provide guidance on how entrepreneurs can best prepare their pitches and what Zetta Venture Partners looks for in potential investments.

- Application Submission: Send résumé and tailored paragraphs to work@zettavp.com.

- Initial Interview: Focus on motivation, fit, and knowledge of the fund.

- Case Study: Analyze startups and market trends.

- Partner Interview: Assess personal fit and long-term potential.

Zetta Venture Partners looks for strong technology, market, and company research skills, effective communication, and a genuine interest in AI and startups.

Steps in the Application Process

The application process for Zetta Venture Partners involves several key steps that startups need to follow to seek investment. It begins with the submission of the application, which includes a résumé and three tailored paragraphs. This is followed by a series of interviews, including an initial interview, a case study, and a partner interview.

Typical Timelines and Milestones

The typical timeline for the application process can vary, but candidates can expect the initial review and interview stages to take several weeks. The process is designed to thoroughly evaluate the potential of the startup and the fit with Zetta Venture Partners.

Preparation Tips for Entrepreneurs

Entrepreneurs should focus on demonstrating their understanding of the market and their startup's unique value proposition. It's important to highlight any traction, team strengths, and the potential impact of their technology. Being well-prepared for case studies and interviews by researching Zetta's focus areas and portfolio can greatly enhance the chances of success.

Market Positioning and Differentiation

Zetta Venture Partners uniquely positions itself within the venture capital industry by focusing exclusively on B2B AI-native startups, particularly at the pre-seed and seed stages. Their dedication to AI applications, infrastructure, and developer tools, combined with a hands-on approach, sets them apart from other VC firms.

Zetta Venture Partners has carved out a niche in the venture capital industry by focusing exclusively on B2B AI-native startups. This specialization allows them to offer unparalleled expertise and resources to companies operating at the intersection of AI applications, infrastructure, and developer tools. Their commitment to early-stage investments, particularly at the pre-seed and seed stages, enables them to be the first significant investor for many startups, providing crucial support as they transition from concept to market traction.

The firm's geographic focus on North America and Europe, with offices in San Francisco and New York, further enhances their ability to support burgeoning AI companies in key tech hubs. By offering initial investments ranging from $1 million to $5 million and reserving follow-on capital for later rounds, Zetta ensures that their portfolio companies have the financial backing needed for sustained growth.

Zetta's hands-on approach is a significant competitive advantage. They actively engage in business development, product strategy, scaling operations, recruiting, go-to-market strategies, and fundraising. This deep involvement, combined with their extensive network of advisors and operators, positions them as a crucial partner in building successful AI-native businesses. Their market thesis, which emphasizes the transformative potential of applied AI in sectors like biotechnology, climate tech, DevOps, security, and cloud infrastructure, underscores their commitment to not only financial returns but also technological advancement.

Zetta Venture Partners Competitive Advantages and Market Impact

| Attribute | Zetta Venture Partners |

|---|---|

| Sector | B2B AI-native startups (apps, infra, dev tools) |

| Stage | Pre-seed, Seed (lead/co-lead majority) |

| Geography | North America, Europe |

| Investment Size | $1–5M typical, up to $40M for select cases |

| Hands-on support | Product strategy, scaling, recruiting, go-to-market |

| Market Thesis | Transformative potential of applied AI in key sectors |

| Reputation & Signal | Validation in AI startup ecosystem |